2015 was the year of the mobile payment platforms. We saw the rise of major platforms like Apple Pay, Android Pay, and Samsung Pay. Also joining the race were other mobile wallets from the likes of Chase Bank and Walmart. With this many players in the mobile wallet industry, there will be consequences.

Why doesn’t every store accept the native mobile payment platform?

The first question to address is why are there so many different payment platforms. Why doesn’t every business simply accept NFC mobile payments platforms like Apple Pay, Android Pay, and Samsung Pay? The simple answer? Money.

When retailers accept credit cards, they pay a percentage fee on every transaction. But when retailers can convince consumers to pay via a mobile app and QR code like Walmart Pay, they can avoid these credit card fees entirely. This is what has stalled major retailers like Walmart and Target from adopting NFC terminals.

It all started with CurrentC

When Apple Pay hit the market, a number of big retailers formed an alliance and invested in their own QR code based mobile payment system called CurrentC. CurrentC was going to be the only accepted mobile payment platform at all of the retailers in the MCX alliance which includes 7-Eleven, Alon Brands, Best Buy, CVS Pharmacy; Darden Restaurants, HMSHost, Hy-Vee, Lowe’s Home Improvement, Publix Super Markets, Sears, Shell Oil, Sunoco, Target and Walmart. CurrentC, which was set for release in early 2015, is still under development and beta testing in Columbus, Ohio. This has lead to many problems with all the retailers that committed to using CurrentC as their mobile payment platform. Which leads us to where we are today.

Today’s new mobile payment entrants

Walmart Pay

Walmart Pay is currently being tested in Walmarts around the US and is set for a full rollout in 2016. Walmart Pay is Walmart’s answer to the delayed CurrentC. Instead of simply adopting NFC and using Apple Pay and Android Pay, Walmart developed their own mobile payment system that has been placed within there app. Walmart Pay uses a QR code to conduct transactions. Allowing Walmart complete control and the ability to avoid credit card fees.

Target Pay

Target Pay was recently announced as Target’s answer to the CurrentC debacle. As of now, Target Pay will use a QR code and an app to conduct the transactions. Which is exactly like Walmart Pay. Target Pay is still in the early development stages but is believed to be preparing for a 2016 release.

Chase Pay

Chase Bank is also looking to disrupt the mobile payment industry with Chase Pay. Chase Pay is a QR code based mobile payment system that can also be used to pay online. Chase Pay has partnered with MCX, which is the group of retailers behind CurrentC. So Chase Pay will be accepted at the MCX partnered stores.

Chase has told retailers that they will pay lower transaction fees on Chase Pay purchases than they do on purchases made with other payment methods, a Chase rep said. This is there incentive for more retailers to accept Chase Pay. Check out the video below to see everything Chase Pay has to offer.

https://www.youtube.com/watch?v=dCUmPmA7Cec

PayPal

PayPal also allows mobile payments through their mobile app. Consumers using the app can pay in store, online, and within certain apps with PayPal. One Touch, PayPal’s mobile payment service, is accepted in stores like Macy’s and Overstock. Consumers who enjoy the known security of PayPal are likely to adopt One Touch as their choice of mobile payments.

Square

Square made an attempt at the mobile wallet a few years back with Square Wallet. As of now, Square is releasing an NFC/EMV reader that integrates with their POS system. But CEO Jack Dorsey has made a few comments that indicate that Square will be getting back into the mobile wallet game. So we will have to wait and see if they also join the mobile payments race.

Why this many players are actually killing mobile payments

I just listed off five QR code based mobile payment systems. None of which come native on a phone. With Apple Pay, Android Pay, and Samsung Pay already fighting for adoption, adding five more ways to pay is not going to help the mobile payment industry. Here’s why.

Adoption

One of the major issues with mobile payments is adoption. Like I said, the big players like Apple and Android Pay are struggling to see widespread adoption as of now. But with so many players entering the mobile payment game, adoption is going to really suffer. Some people believe the more the merrier. But this may not be the case.

With so many mobile wallets for consumers to choose from, consumers aren’t going to adopt at all. The main purpose of a mobile wallet is to have a convenient, well organized place where everything goes. Well this is no longer happening. Consumers now need Apple Pay to purchase from Walgreens, Walmart Pay for Walmart, and Target Pay from Target. That is not convenient. That is a hassle. And I promise consumers will choose a plastic credit card and leather wallet over having five different mobile payment options.

Security

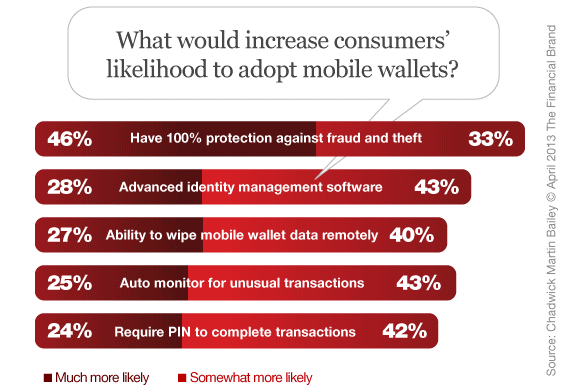

Another issue with having this many mobile payment providers is security. Consumers’ number one concern about mobile payments is security. If it is this hard to convince consumers that Apple Pay and Android Pay are secure, is it going to be easier to convince them that each store’s mobile app is equally secure? I believe the answer is no.

But it isn’t all just about adoption. There are also legit security concerns. Can we trust retailers like Target? Who have had breaches in security in the past, with our payment information? Can Target produce the level of security necessary to run a full mobile payment system? I guess only time will tell.

Defeats the purpose of mobile wallet

One of the main problems with this many mobile payment platforms is that it defeats their purpose. The core reason for using a mobile wallet is it allows easy storage for everything you need in one native application on your smartphone. Credit cards, coupons, loyalty cards, boarding passes, event tickets, anything you may find in a normal wallet has a place inside a mobile wallet.

With every store forcing consumers to download their app, it’s defeating the core purpose of the mobile wallet. Consumers will no longer have all of their mobile wallet content conveniently located in one place. Now it will be spread in all different places in their phone. This will ultimately lead to the demise of mobile payments.

Survival of the fittest or no survival at all?

Most of the time competition in any industry is a good thing. It makes products better and consumers receive more value. But in the case of mobile payments, competition may kill everybody.

In order for the industry to survive, consumers will need to choose one mobile payment platform and stick with it. If consumers choose Apple Pay and refuse to use Walmart Pay, then Walmart will eventually be forced to adopt NFC terminals and accept Apple Pay. As someone who enjoys using mobile payments, I hope this happens sooner rather than later. Because if consumers don’t choose and businesses don’t adopt, there may be no mobile payment to choose from at all.

What do you think? Do you think all this competition will raise adoption rates?