The mobile payment industry continues to grow as more and more players enter the game. It started out with a couple lone entries by Google and Apple. Today, there are so many different apps and companies that allow you to make a mobile payment, it’s hard to keep track.

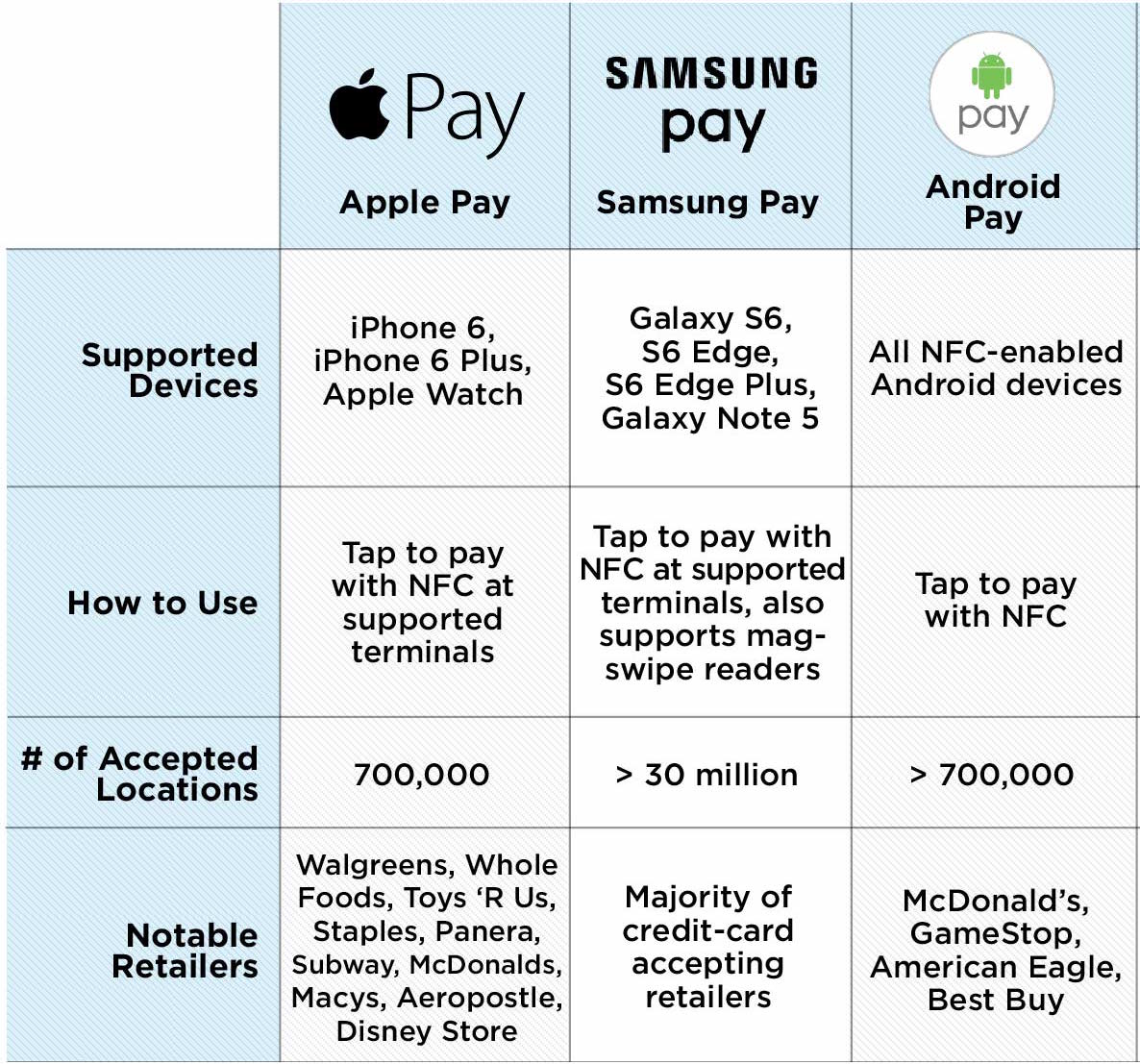

Overall, there are a few major players that are controlling a majority of the mobile payment industry. What do they have in common? They all end in pay. So here is: The Rise of The Pay’s. How Apple Pay, Android Pay, Samsung Pay, and LG Pay are giving life to mobile payments.

The Rise of the NFC enabled Smartphone.

NFC enabled smartphones are growing at a rapid pace and are only going to keep growing. With both the iPhone 6 and 6s having NFC, a majority of iPhone users now have the ability to make mobile payments.

On the Android side, a large number of users already have NFC enabled smartphones and this number is also growing. Nearly all Android phones being released today have NFC within them.

Samsung is also stepping up their game but with an even stronger angle. The Samsung Galaxy is able to make payments through both an NFC terminal as well as through magnetic readers. This makes their mobile payment service accepted at nearly every store.

The new kid on the block.

The latest to join to mobile payment race is LG. While typically being known as a lower end copycat of Samsung, LG is trying to carve their own way into the mobile payment sector.

Planning to roll out in Korea starting December 2015, LG has two launch partners, South Korean credit card issuers Shinhan Card and KB Kookmin Card. Both LG and Samsung have an advantage by doing their initial rollout in Korea. Korea has much higher adoption rates for new technology and embraces mobile payments faster than America does. This gives them a leg up in working out the kinks before the service ever hits America.

While it’s currently unclear how Android Pay and LG pay will work together on the same system, LG does say they will support both on their phones. Regardless of what happens to LG pay in the long run, it’s another major player entering the mobile payment battle.

How many people are using mobile payments?

In the U.S., mobile payments account for around 16.2% of transactions. In dollar amounts, this is $8.71 billion worth of transactions with users spending an average of $376 annually through mobile payments. This number is expected to reach $27.05 billion by 2016 with users spending an average of $721.47 annually. The projected growth in just one year says how powerful the mobile payment industry is about to become.

In terms of how many people are using mobile payments, that number is also growing. According to a survey from banking consultancy, Mercator Advisory Group, 71.5 million U.S. adults used mobile payments in 2015, up from 61 million in 2014.

Frequency that adopters use mobile payments

So for the people who have adopted the mobile wallet into their lives, how frequently are they using it?

Apple Pay is the most used mobile payment service by far. It is used on average more than all of the other mobile payment services combined. The same Mercator Advisory Group study also looked at the frequency in which people are using mobile payments vs Apple Pay.

We can see that in August 2015, a majority of the people using Apple Pay used it between 5-9 times per week. Other mobile payment services were used far less than Apple Pay. But the reason for this may be due to that Apple Pay has been around much longer than its newer competitors. With the rise of Samsung and Android Pay we may see the numbers balance themselves in early 2016.

Apple Pay: In-Store vs In-App

Apple Pay can now be used both in store and within certain apps. So this also helps adoption rates. Consumer Adoption Monitor surveyed users to get a handle on the frequency rates between In-Store vs In-App purchases for the month of June 2015. Here are the results.

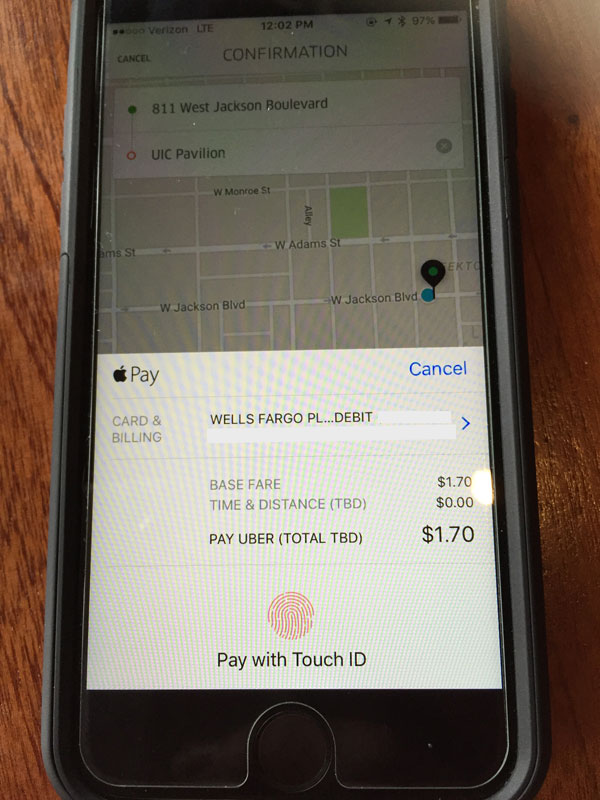

As you can see, In-Store purchases are more frequently used than In-App. But not by much. I do believe that now we are seeing more In-App purchases due to the increasing amount of apps that are accepting Apple Pay. I personally used Apple Pay to pay for my Uber directly through the app and it was a tremendous experience. You can also pay for trains, hotels, and even food with Apple Pay directly through the businesses app. Making paying much easier than having to enter credit card information repeatedly each time you want to make a purchase on your phone.

When it comes to In-Store, frequency is tricky. Since the number of businesses that accept mobile payments is fairly low, it requires users to visit the same place on a consistent basis in order to be a frequent user of Apple Pay. Which brings me to a very important topic within the adoption of mobile payments. The barriers that are slowing down adoption.

The barriers that are slowing mobile payment adoption

Location, Location, Location.

As of now, user adoption is a difficult task to accomplish. With not very many retail locations accepting mobile payments, it makes it very difficult for consumers to rely on the ability to pay with their phone. Which defeats much of the convenience factor of mobile payments. There have been many times that I believe a location has Apple Pay(McDonald’s is a good example) but I still bring my wallet in just in case they don’t have it. And in one instance, I was thankful that I did.

For those of you who didn’t know, you can see whether or not a location accepts Apple Pay by clicking on them within Apple Maps. The problem is that these aren’t always accurate. In my case, my Apple Maps showed that a McDonald’s near me accepted Apple Pay. In turns out they didn’t have NFC terminals at all. This is a huge problem regarding consumers trusting whether or not they can pay with their phones. And if they still have to bring in their wallet everywhere they go, a majority or users will just pull out their credit card instead of using a mobile payment.

The frequency rates that we saw above will also begin to rise as NFC terminals become more available. I believe this plays one of the largest factors in the adoption of mobile payments. The good news is that more and more locations are being enabled every single day. So it is only a matter of time before we can rely on the ability to use mobile payments.

Non-users number one concern is security

Security remains the other largest barrier of mobile payment adoption. Many people just do not believe that storing their credit card information on their phone is a good idea. With the frequent breaches of major stores such as Target, people have learned to mistrust anything that stores their financial information. Making it very difficult to convince consumers that mobile payments are secure.

A total of 73% of non-users cite security as the number one concern that they have about mobile payments. In “The Mobile Moment: Barriers and Opportunities for Mobile Wallets,” Chadwick Martin Bailey dug in deep as to what the barriers were for mobile wallets and mobile payments. They gained some good insight into what’s stopping consumers.

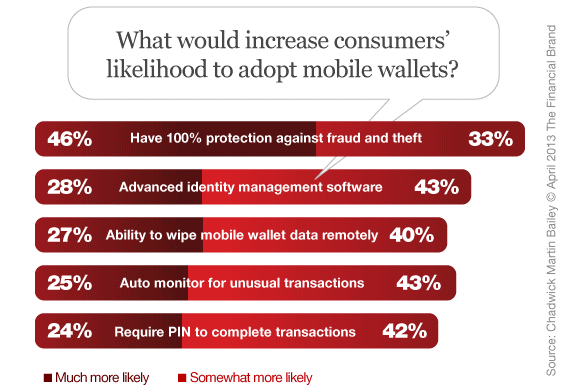

Consumers also gave some insight as to what might help them feel more comfortable making mobile payments.

As you can see, security is playing a huge role in mobile payment adoption. Emphasizing the security of the mobile wallet would really help raise adoption rates. And if banks and credit card companies teamed up and gave 100% protection against fraud and theft on mobile payments, we would see a big rise in the usage of mobile payments.

“These findings reveal that consumers are still in the early stages of understanding the uses and benefits of mobile wallets,” says Jim Garrity, SVP of Chadwick Martin Bailey’s Financial Services practice. “There remain many elements — players, features, positioning, etc. — that will evolve over the next 12 to 18 months.”

The rise of mobile payments: How these barriers are being broken

More retailers are adopting mobile loyalty cards/encouraging adoption

Having every major player in the cell phone industry will help the mobile wallet and mobile payments take hold and gather more retailer support. With Apple taking the lead, they expect Apple Pay to be accepted in 1.5 million locations by the end of 2015. And this number is only going to keep getting bigger.

As mentioned before, the location barrier of mobile payments is one the will gradually be overcome overtime. But as of now, retailers and credit card companies of gotten creative in order to increase the usage of mobile payments.

Perhaps the most shocking of all, is a promotion being run by Mastercard and London’s Tube. Mastercard is running their “Fare Free Mondays” promotion to encourage people to use their phones to purchase public transportation. “Fare Free Mondays” will run on November 23rd, November 30th, December 7th and December 14th. To make use of it, simply tap in and out of the barriers with your Apple device and your travel will be refunded up to £27.90. That’s right, you can travel for free just by paying with your iPhone. This is one way to get people to try out a new service.

Another way is by tieing the mobile wallet in with services other than just payments. Walgreens was the first to adopt this mantra. At the beginning of November, Walgreens made their loyalty card NFC enabled. This allows users to use their Walgreens Balance Rewards card the same way they use Apple Pay. Just pull out your phone, open Wallet, and tap the rewards card against the NFC terminal. By having customers do this, Walgreens is also encouraging them to use Apple Pay at the same time. Check out the video below to see it in action.

As mobile payments continue to grow, people will see the convenience and the benefits the mobile wallet has to offer. And this will also help increase adoption. A good example are airplanes. Instead of having to dig for your wallet when purchasing a drink on an airplane, you should be able to simply pay with your phone. JetBlue remains as one of the only airlines to be Apple Pay enabled during flights.

Mobile wallet security concerns are simply a matter of time and education

The good news about the security concerns are that it is only a matter of educating the consumer about how mobile payments work. Many consumers referenced being nervous about losing their phone. What many of them do not know is that even if someone were to get ahold of their phone, they would still have to replicate the owner’s fingerprint. On top of that, the person who lost their phone can log into Where’s My iPhone and place the phone in lost mode, which immediately disables Apple Pay.

Users also expressed concerns over credit card information being stored on the phone. So let’s break down how it works.

Is adding a credit or debit card into Apple Pay Secure?

A major concern for most people who are worried about the security of Apple Pay, is adding debit or credit cards to their mobile wallet. Apple has gone to great lengths to ensure that all data is immediately encrypted and is never stored by Apple on any server or device. Your bank is the only server who stores your real information. They encrypt it, send it back to Apple, who then stores it within the Secure Element on your device, via a Device Account Number.

The Apple Pay Device Account Number that is stored within the Secure Element is unique to your device and the card you added. This number is also different from the physical number stored on your regular debit or credit cards, so that your bank can prevent the Apple Pay version being used on magnetic stripe readers, over the phone, or via websites. This process is also referred to as tokenization. Which you can learn more about here.

Learn how to enter a credit card via a photo

Apple Pay security when paying in stores

When using Apple Pay in stores, Apple uses (NFC) technology between your device and the payment terminal. As soon as your phone detects an NFC terminal, Apple Pay will automatically pull up your default card, and then in order to verify the payment, you must scan your finger into the Touch ID or enter your passcode. If using an Apple Watch, you must double click the side button when the device is unlocked in order to activate your payment – something you can only do when it’s on your wrist or unlocked with the code (for security reasons).

Once you have approved the payment, Apple Pay takes your Device Account Number, a transactional-specific security code, and any other necessary information, and sends it to the point-of-sale terminal. Your credit or debit card number is never released to the retailer. Before the payment is fully approved, your bank or payment network can verify your payment information and confirm the process. This makes it very difficult to steal any information out of a transaction.

So with just a minor amount of education, we can teach consumers that mobile payments are in fact very secure. It will just take time for consumers to accept this, just as it did with Atm’s, credit cards, and online shopping.

The Future of mobile payments

Mobile payments aren’t going anywhere soon. With this many players in the game and retailers just now getting on board, it is safe to say that mobile payments are merely in their adolescence. In a few short years, mobile payments won’t be about payments at all. But rather about the customer experience and how the mobile wallet can provide businesses with opportunities they didn’t previously have.

78% of non-mobile payment users say the ability to gather information while shopping would increase their likelihood to adapt. Luckily for them, this is exactly the direction business is headed. With the online and offline worlds of commerce beginning to come together. We will see more businesses integrate the information they provide on their website with their in-store shopping experience. If you want to read more about that check out O2O: The Opportunity, The Journey, And The Future.

As said best by Paul Tomes

“Mobile payments and the mobile wallet gives marketers and businesses the ability to connect the online and offline worlds of commerce together. This type of connection and service to the customer is unlike anything we have seen before.”

-Paul Tomes, CEO and Co-Founder of PassKit

With retailers, banks, and big tech companies gunning for the success of mobile payments, we know they have a good shot at becoming successful. It is just a matter of time before a few winners emerge and mobile payments become a routine within our day to day lives. But for now, we will have to settle with many different providers and count on each one of them to continue to give life to mobile payments.