As Apple Pay usage numbers are released, more and more people are taking to the internet to share their view on Apple Pay and mobile payments as a whole. I have seen many of these articles attempt to address the issue as to why Apple Pay may be seeing low numbers. The problem is that every single one of these articles is wrong.

First things first.

Apple Pay adoption is tricky. There are many variables that can deter a consumer from using Apple Pay. First, they must have an iPhone 6 or 6s in order to have access to Apple Pay. Second, their credit or debit card needs to be supported within Apple Pay. While this issue is quickly going away as Apple Pay is now partnered with over 400 banks, it is still an issue for some. And third, which is the biggest issue of the three, is the fact that not very many stores accept Apple Pay or any form of contactless payments. This makes relying on Apple Pay near impossible.

Despite these three main factors, many critics of Apple Pay still place the low usage rates of Apple Pay on another factor entirely. But before I get to this factor, lets first take a look at Apple Pay usage and adoption rates.

Apple Pay Usage.

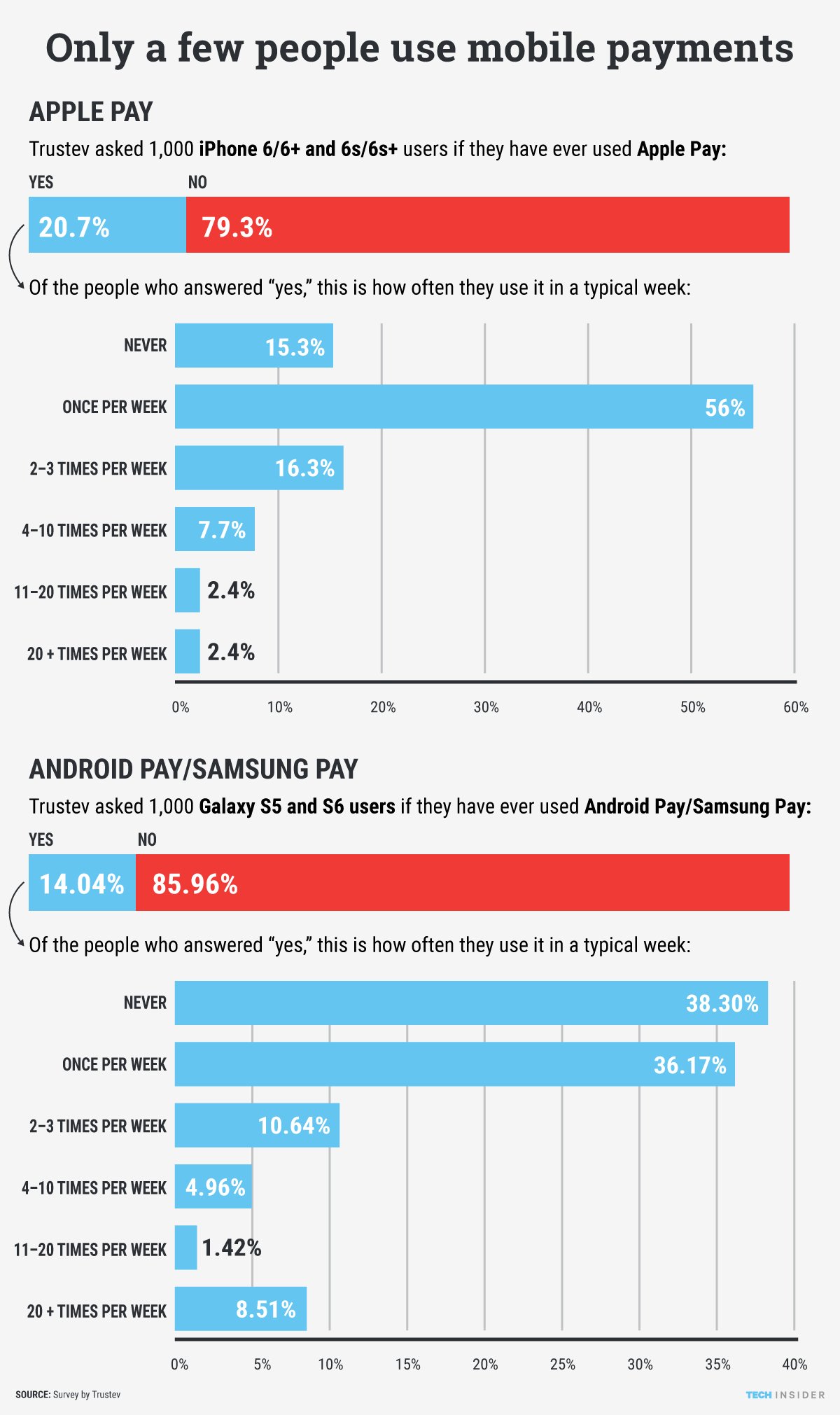

Business Insider reported that “According to a new study from Trustev, a company that helps retailers and banks prevent online fraud, not that many people are actually using the new technology even though they have it on their phones. Trustev found that only about 1 in 5 people (20.7%) in the US who have an eligible iPhone that works with Apple Pay, that is the iPhone 6 and newer, have even tried Apple Pay. Of those who have used Apple Pay, 56% report that they only use it once during a typical week, and 15.3% say they “never” use it during the week.” You can see these and more stats on the graph below.

Side note: Part of the reason Apple Pay numbers are dropping among eligible users is because late adopters are now getting the iPhone 6. Naturally, they are not going to then be anxious to try out a new payment system such as Apple Pay. But nonetheless, Apple Pay’s numbers are low. There is no arguing that(even though Apple tries).

Also included in the stats is Android Pay/Samsung Pay, whose usage is even lower than Apple Pay. For this article I am going to focus on Apple Pay, not only because more people use it, but also because Apple Pay offers more within their mobile wallet such as NFC enabled loyalty cards. But what I say in this article really applies to mobile payments as a whole. Not just Apple Pay.

So we now know that only a few people are using Apple Pay and even they aren’t using often. While the three factors I started the article with all play a role in this, there is one more factor that will make or break Apple Pay. The articles that I’ve been referring to believe the reason that Apple Pay isn’t taking off is simple.

Apple Pay doesn’t solve a problem.

People don’t mind using credit cards. So therefore, Apple Pay is seeing low usage rates because it doesn’t solve a problem for the consumer. At least that is what many people are trying to claim. In fact, here’s the quote from the article-

“It just seems to me that there’s not much of a problem Apple Pay fixes,” Bradbury said. “Paying with a credit card is very easy. It’s a habit everyone has.”

Indeed, Trustev also found that more than 82% of survey respondents reported that paying with a credit card in a store is “very easy” or “easy.”

“Apple Pay is trying to replace something which is not a problem for people so they don’t really have much interest,” Bradbury said. -Here’s the link to that article from Business Insider.

Rurik Bradbury, the chief marketing officer of Trustev, who said those quotes, is not alone in his thinking. Many other people have also come out and said that they don’t feel that Apple Pay really solves a problem. And this is the last major factor that people believe is keeping Apple Pay usage low. That it doesn’t solve a problem.

Here is where all of these people go wrong.

They are too focused on the problem that Apple Pay solves rather than the opportunity Apple Pay presents.

The real reason for Apple Pay.

Apple Pay was never meant to solve a credit card problem because we don’t have a credit card problem. Instead, Apple Pay was meant to be a small incremental step into something else entirely.

See, mobile payments mean more than just tap to pay. They mean an entirely new customer experience. And Apple Pay is just one facet of this new experience.

The future of Apple Pay lies beyond payments.

Mobile payments allow for everything within the consumer experience to become better. Everything from when the customer walks by a store to the moment they leave, is going to change. Changing the consumer experience is what Apple Pay is about. Not trying to solve a credit card problem.

The Big 6. 6 ways the mobile wallet is more than just payments.

I am going to give you six ways that Apple Pay and Apple Wallet can make the customer experience better. I choose these six because they can be easily implemented right now. These aren’t ideas for the future but rather things that some businesses are already doing to increase their customer engagement. These six ways that make the consumer experience better are the reason Apple Pay was created in the first place.

1. Greet the customer by name.

This concept of greeting customers as they come back to your store is nothing new. In fact, it’s been around since the beginning of commerce. But now, as stores grow bigger, it becomes much more difficult for employees to remember everyone’s name and what they purchased last time they stopped by. Well now the mobile wallet has you covered.

Your business can greet your loyal customers as they enter your store, reminding them what they bought last time and updating them on your newest products or specials. This adds value to your customers and makes them feel appreciated by your business.

2. Offers powerful coupons and loyalty cards.

The second way ties directly into Apple Pay. Paying with Apple Pay makes it much easier for consumers to redeem coupons and loyalty cards. Apple Wallet allows for NFC enabled passes, which means that when a customer goes to use Apple Pay, their loyalty card or mobile coupon will automatically be scanned by the NFC terminal. This eliminates the need to remember and keep track of your loyalty cards and coupons.

Remember the greeting you gave your customer? Well you can offer them a coupon within that greeting and it can be added to their wallet right then and there. Nothing’s better than being greeted at the door and then receiving a discount on your favorite item.

3. Thank the customer by name.

As much value that was created when the customer entered the store can be created again when they are leaving. After the customer pays and redeems their loyalty points. Your business can now thank them for coming with a personalized message. Making it known that you appreciate their business and hope they return. Here’s an awesome article explaining Why You Should Always Be Thanking Customers. Spoiler: Number 1 is that your customers always want to feel valued.

4. Easily remain in connection with your customers.

Remember how in step three you thanked your customer for coming with a personalized message? Don’t stop there. After a couple days, you can surprise your loyal customers by updating the pass inside their mobile wallet with a fresh offer. This will help bring them back into your store while also showing your appreciation for their business. This is more powerful than email, text, and obviously paper coupons. This feature of the mobile wallet is exactly what I’m talking about when I reference the opportunity Apple Pay and the mobile wallet present.

5. Measure customer data to provide better value and more meaningful offers.

With mobile wallets, you can take the previous four things and measure every single one of them. Allowing you to know your customers better than ever before. This will help your business make more relevant offers and provide even more value to consumers. Businesses can eliminate the mystery as to wondering what their consumers think about their promotions and offers. The mobile wallet makes it easier than ever before to gain insightful knowledge about your consumers.

6. Mobile Payments are secure(yes, you read that right).

Apple Pay offers consumers greater security when making purchases. Is giving your credit card to a waiter or waitress safe? No. Is entering your credit card information online safe? No. But with Apple Pay and it’s unique secure element, making online and offline transactions is safer than ever before. One of the reasons that consumers are reluctant to make the switch to Apple Pay is that they don’t trust it. The problem with that is that they should trust it more than a plastic credit card. It is much more secure. You can learn why here.

These are the six things that will make up the new customer experience. Apple Pay is a small, but extremely important part of that. Without Apple Pay, it would be very difficult for consumers to adopt the mobile wallet at all. But with Apple Pay, consumers will begin to slowly adopt the mobile wallet. The problem right now is both mobile wallets and mobile payments are trying to gain mass adoption without working together as one.

Not quite there yet.

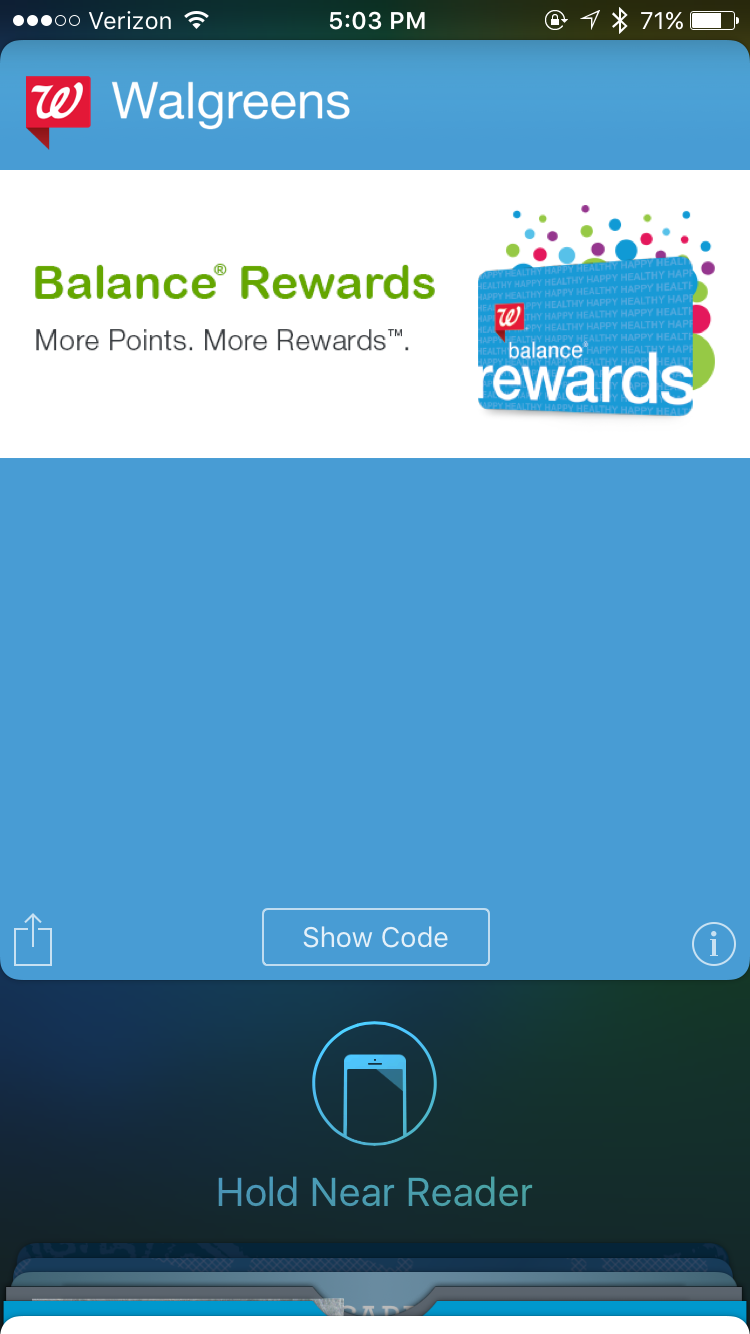

In my article last week, I showed my failed attempt at using what at the time seemed to be a NFC enabled loyalty card at Walgreens(I later found out the loyalty card was not NFC enabled. Check it out here). The fact that Walgreens and other retailers have still not integrated NFC loyalty cards is what is really hurting Apple Pay adoption.

The opportunity that Apple Pay and the mobile wallet present for both businesses and consumers is what will drive adoption on a mass scale. When the consumer experience begins to fully change and becomes much better through the mobile wallet, is when we will see adoption rates rise. Not when the credit card becomes inconvenient to use.

The Mobile Wallet must provide value.

Because Apple Pay is not trying to win over consumers due to a convenience factor, then it must provide more value than the alternative options. Such as paying with a regular credit card. The difficult part of this is that it takes effort from businesses to make this happen. And businesses are taking their sweet time implementing mobile wallet content. But I promise, when this does finally happen you will see Apple Pay usage rise faster than ever before. Consumers care about their experience and they will change if it means that they receive more value and a better experience.

Apple Pay’s day will come. And consumers will wonder what took them so long.

Apple Pay will eventually see it’s day. It will rely on businesses to focus more on the consumer experience and the value that they provide, and that day is also approaching quickly. We have seen tremendous results from businesses who use mobile wallet marketing as part of their marketing strategy.

Right now, the mobile wallet and Apple Pay are not working together like they soon will. They are still running separately(even though they’re both stored in Apple Wallet). Once businesses start to use BLE beacons and the Physical Web as well as push notifications and chain passes, consumers will be flocking to the mobile payment platform. But for now, Apple Pay must fight for adoption and remain in competition with the credit card.

Just remember. Apple Pay is not trying to solve a credit card problem but rather present the mobile wallet opportunity.

While I packed a lot of information into this article, that is the key takeaway. Apple Pay is about the opportunity the mobile wallet provides. Once that is discovered, defeating plastic credit cards will be talk of the past.

What are your thoughts? Do you think Apple Pay is fighting the convenience battle with the credit card or are you with me in that Apple Pay represents much more than mobile payments?