Companies and consumers embrace mobile technologies like smartphones, tablets, and wearables to conduct online and offline transactions. Relationships between businesses and consumers are slowly but surely becoming digitalized as companies adapt to their customers’ changing requirements.

Modern customer experience should be safe, convenient, and germ-free. It is particularly important during the COVID-19 pandemic, which has been one of the biggest drivers for the mass implementation of mobile wallets. Here are some stats that support this:

- During the pandemic, mobile payments have increased by 23%

- The US alone has processed over $456 billion worth of mobile wallet transactions

Since digital devices have also become an extension of ourselves, it is apparent why technology like mobile wallets is becoming prevalent across all industries and why this trend is here to stay even after the pandemic ends. By implementing mobile wallets in your business, you’ll enjoy an increased customer retention rate and many other benefits, which we’ll discuss in this article.

This innovation has the power to help you disrupt the industry and increase your customer loyalty. Be quick to learn more about mobile wallets, why they’re so amazing and why you should start using them in 2022.

What are mobile wallets?

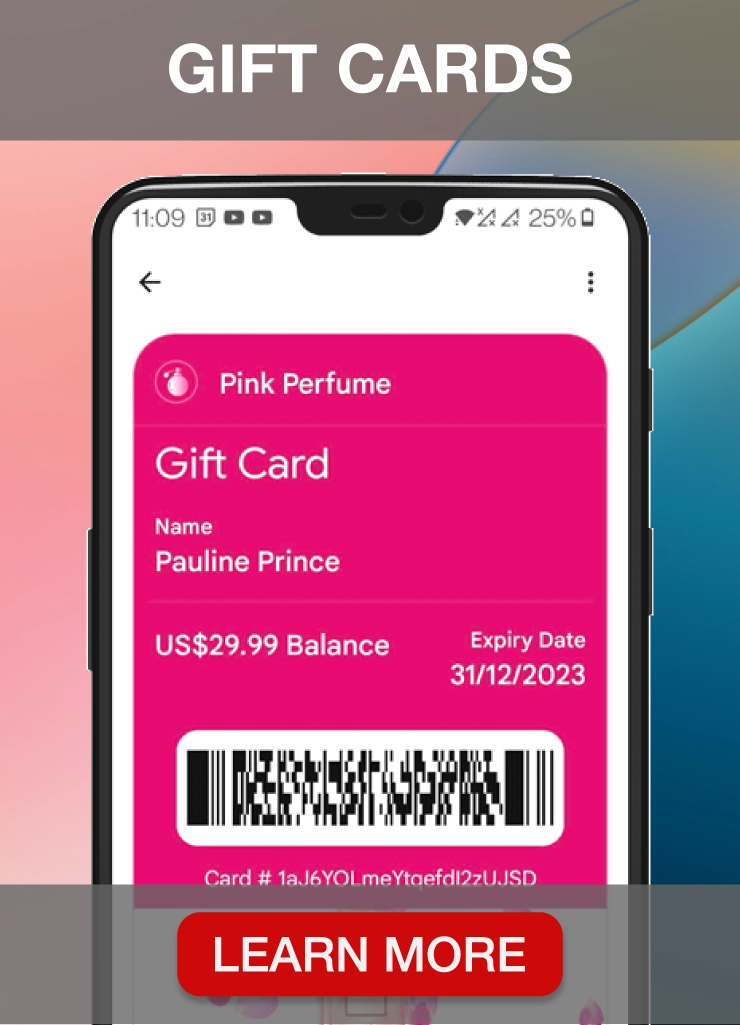

Mobile wallets are the latest innovation in the electronic payment industry. A mobile wallet is a virtual wallet that holds all your payment information and digital passes in one place:

- Debit and credit cards

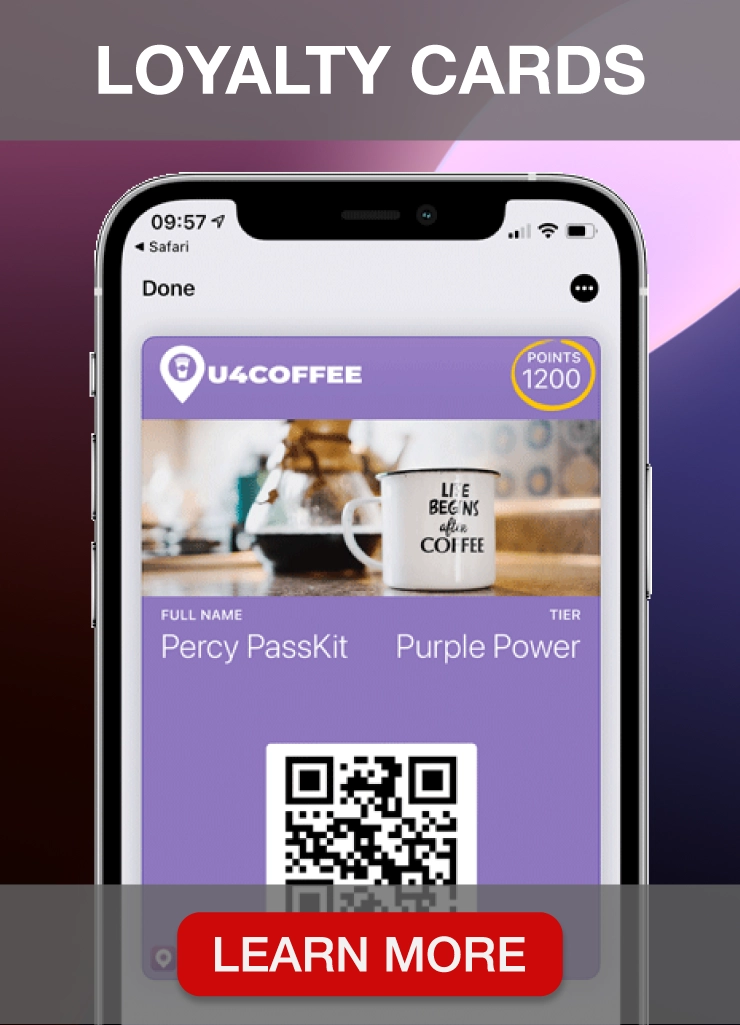

- Loyalty cards

- Reward cards

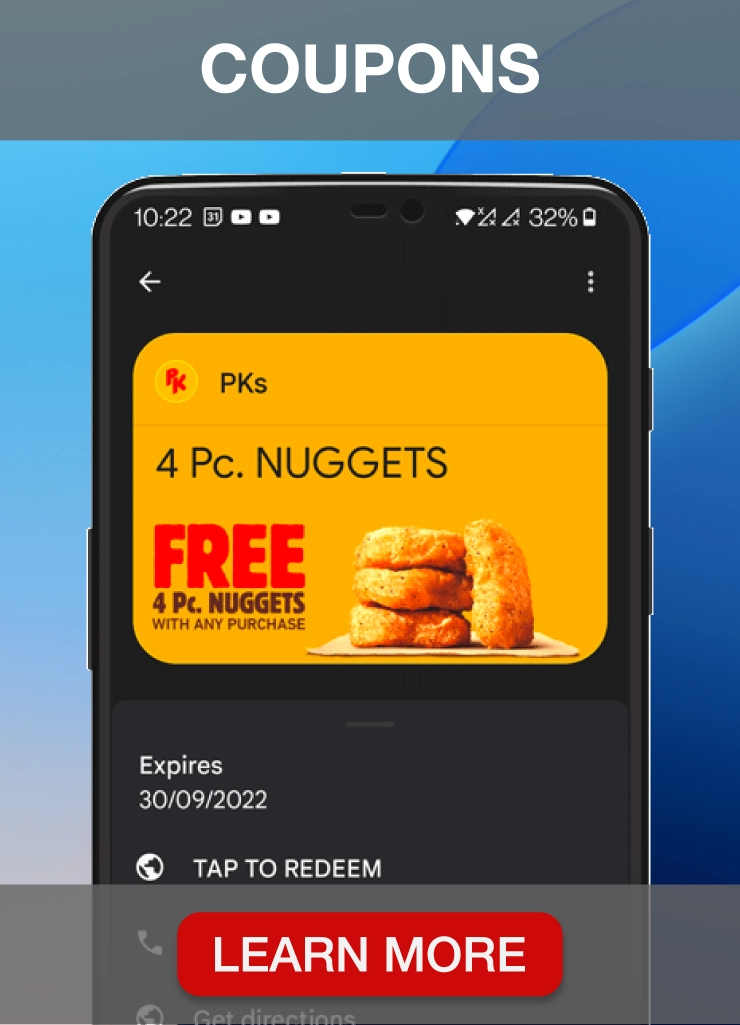

- Coupons

- Resort passes

- Boarding passes

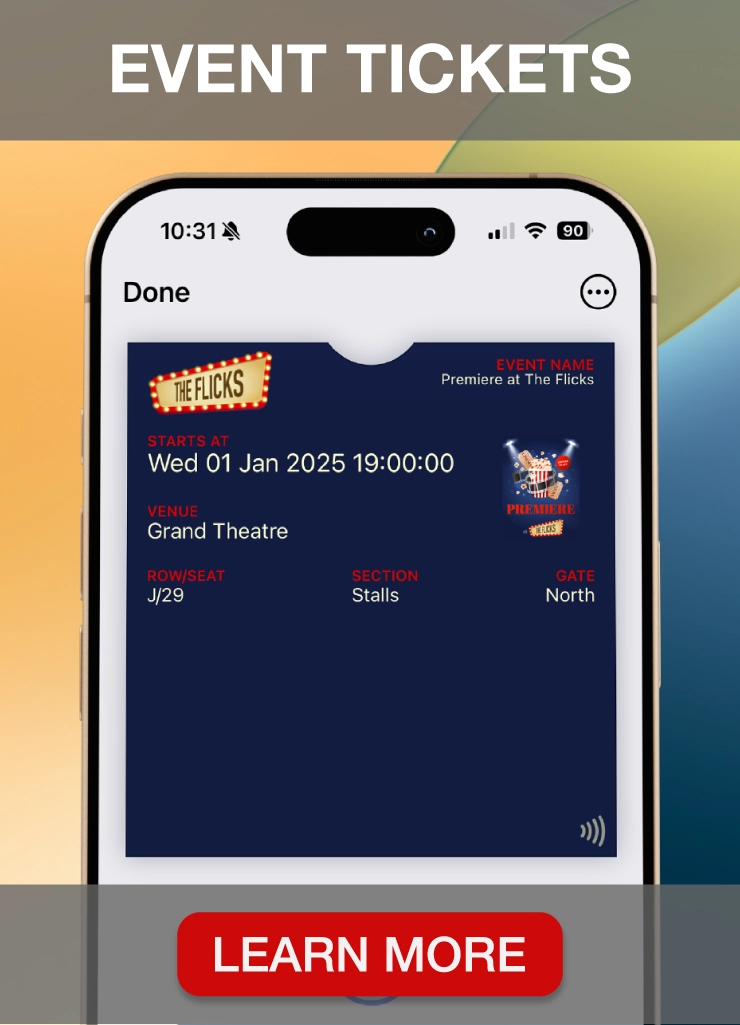

- Movie tickets

Here’s how mobile wallets work. Instead of using a physical credit card, you can load your card number on your mobile device and use it to make payments in different locations. You can load payment information on all types of mobile devices – smartphones, smartwatches and tablets.

It’s easy to see why this payment method is slowly becoming prevalent. Mobile wallet payments are a convenient way to buy anything you want without rummaging through your wallet looking for a physical card. Just open a dedicated mobile virtual wallet app on your phone, point it towards the terminal and that’s it. Here are some other reasons you should consider using a digital wallet for personal and business purposes.

Why should you use a mobile wallet?

Mobile wallet technology offers many benefits compared to traditional payment methods. For consumers, the main selling points are safety and convenience. Using mobile wallets for in-store and online purchases helps them save time looking for the correct card or constantly having to run to their wallet to look up credit card information. Instead, they’ll be able to make payments with a couple of taps.

Moreover, they can leave their plastic credit cards at home instead of risking losing them and then having to pay card cancellation fees. All their favorite loyalty and reward programs can also be integrated with the app so they can easily keep track of their loyalty points at all times.

Implementing and encouraging mobile wallet technology through services like PassKit will help you score more customers and increase customer loyalty. It also decreases the chance of fraud thanks to elaborate security measures. You can use PassKit to create digital loyalty cards, digital membership cards or digital coupons for your loyalty and reward programs or enable your customers to make payments via their mobile devices. If you want to learn how PassKit works, check out the section below.

How does a mobile wallet work?

Digital wallets work thanks to a near-field communication chip, also known as NFC technology, which is the same technology that allows customers to make contactless payments with physical credit cards.

There’s no better way to improve customer experience than to make payments and reward programs contactless and effortless for your customers, which is why you should try using our tool – PassKit.

Thousands of businesses worldwide use PassKit to connect and engage with customers.

You can create attractive and engaging digital passes within minutes thanks to our built-in editor and a plethora of additional features and options, such as:

- Member manager – this feature lets you create digital membership cards and loyalty cards for Apple Wallet and Google Pay users.

- Coupon creator – it is an easy-to-use pass design tool that lets you create show-stopping passes, coupons and campaigns for Apple Wallet and Google Pay users.

- Developer kit – use our developer kit to easily integrate Apple Wallet and Google Pay Passes into your applications. We also offer customized services depending on the size of your business.

Loopy Loyalty is another of our products that lets you create, manage, and assign digital punch cards that customers can use after each transaction. When customers collect enough punches, they can use them to unlock rewards. It helps your business retain customers, increase customers loyalty and drive repeat purchases.

PassKit is the most comprehensive service out there supporting mobile wallets as a potential payment method for your products or services. Our technology enables businesses across the globe to enhance their loyalty programs and let customers complete payments via popular mobile wallets like Google Pay or Apple Wallet.

We have issued over 350 million passes so far, and the number is continuously rising. We serve clients across different industries, such as:

- Burger King

- Heathrow airport

- Subway

- Best Western International Hotels & Resorts

- Azul Airways

What our customers love the most about our service is how easy it is to customize. You can create different passes like stamp cards, membership cards, and digital coupons for your loyalty programs and seamlessly integrate Apple Wallet and Google Pay into your applications. Try PassKit for free to learn why thousands of businesses choose us.

Where can you use mobile wallets?

You can use a mobile wallet for pretty much anything, just as you would use your regular physical wallet. The most common mobile wallet use cases are in-store purchases, online purchases, buying flight tickets, buying groceries, paying bills, saving loyalty cards, coupon codes, reward cards and hotel key cards. You will see all your payment and reward program information on your mobile wallet dashboard, where you can easily manage different payment methods.

How secure are mobile wallets?

As long as you choose the correct mobile wallet provider, you won’t worry about any security issues. The thing with traditional credit cards is that they’re easy to lose, misplace, duplicate and steal. When you have all your information loaded onto a single application that implements strong security protocols, no one will be able to access that information even if they steal your phone.

While the security of mobile wallets depends on their respective providers, using services like PassKit to enforce mobile payments will make sure that there are no security leaks.

At PassKit, we employ industry-standard security protocols for data transmission, such as:

- JSON/XML/HTTP over SSL, with certificate-based authentication utilizing a 1024-bit (or larger) RSA public key and 128-bit (or stronger) symmetric encryption.

- Digitally signed and encrypted S/MIME messages over HTTP or SMTP, using certificates with a 2048-bit (or larger) RSA public key and 256-bit (or stronger) symmetric encryption.

For example, if you need to authorize a digital signature, our app will verify the digital signature first and reject any transactions with an invalid signature.

What’s also great about PassKit is that it can customize the level of security depending on your company’s specific needs. Our team will assess your technical capabilities, transaction volume, latency requirements and availability requirements to custom-tailor a perfect solution for your business.

Book a premium consultation with PassKit’s experts to learn more about security and various ways of integrating our solution into your CRM system.

How can mobile wallet payments improve your business?

The convenience of mobile wallets is more than enough for many businesses to jump ship and choose it as a preferred payment method. Just look at the numbers and you’ll see why your business must jump on the trend as soon as possible:

- Approximately 56% of the consumer population within the US are using mobile wallets for in-store purchases

- 1.31 billion people will use mobile payments as a cashless payment method by 2023

- 70% of the millennial population finds discounts & rewards to be important motivational factors for mobile payment usage

Besides convenience, there are some other benefits that your business will reap once you decide to implement mobile wallets as an additional payment option, such as:

- Decreased chance of fraud – physical cards are easily lost and misplaced, making them very insecure. Counterfeit bills are another significant source of trouble for companies when it comes to cash. On the other hand, mobile wallets are almost impossible to steal or copy because of impressive security and encryption.

- Speed – speed and efficiency are essential for enterprises and high-volume businesses. Mobile wallets enable both customers and business owners to make payments in a matter of seconds.

- Cheaper fees – regular credit cards have some of the most expensive transaction fees. Digital wallet payments have lower costs and the transaction price will drop even further in the coming years.

- Increased customer loyalty – you can use mobile wallet apps to deploy various loyalty programs that incentivize your customers to continue buying your products or services. If you partner with high-profile digital wallet apps like PassKit, you can send different promotions, coupons or special deals to your customer base.

Revolutionize your business with PassKit

Enabling mobile wallets as a payment method has become the standard. More and more companies like Burger King or Best Western International have chosen to incorporate mobile wallet payments into their strategies. And, they chose PassKit as a favorite solution to help them create attractive loyalty programs and digital wallet passes.

PassKit is a software as a service that offers the easiest way to turn physical store cards and vouchers into digital passes that customers can store and use with their built-in digital wallet without the need to download an actual app.

Schedule a consultation call with one of our experts or sign up for our service – it’s time to modernize your transactions with PassKit.

FAQ

Which mobile wallet is the best?

The best options are Google Pay, Google Wallet, Apple Wallet, CashApp, PayPal, and Samsung Pay when it comes to mobile wallets. You can use services like Apple Pay to store coupons and make payments.

What are mobile wallet apps?

A mobile wallet app is a technological solution that can fully replace your credit and debit cards. It’s a mobile application where you load your current credit card information, gift cards and coupons, and you use it to make payments on any digital payment terminal. Instead of filling your wallet up with an excessive number of cards, you can load all of them on your mobile device and enjoy quick and contactless payments. You can use these apps for both online and in-store purchases.

Benefits of using a mobile wallet

Since we’ve already offered a more comprehensive overview of all the benefits associated with the use of mobile wallets, this is the perfect place to give you a quick rundown of all the pros we’ve discussed in the article so far:

- speed

- reliability

- strong security

- convenience

- it improves your customer engagement strategy

- reduced chances of fraudulent activities

- employing reward systems to increase customer loyalty

- simplicity

- accessibility

- you can load more than one payment option on your mobile wallet app

- they’re easy to customize to fit any business’ needs

- automatic payment feature

- decreased risk of losing your payment cards or having someone tamper with them

- they’re more versatile compared to traditional payment methods

How do customers use mobile wallets to pay?

The process of using mobile wallets for payments is straightforward. Here’s how it goes:

- Choose a mobile wallet app and download it on your phone, smartwatch or tablet

- Follow the instructions on how to set up the app

- Load the app with your credit cards, membership cards, loyalty cards, gift cards or coupons

- Once you need to make a purchase, open the mobile wallet app on your phone

- Choose a payment method – Samsung Pay, Google Wallet, or Apple Pay

- Tap your phone on a digital-payment-enabled terminal, just like as you would with a contactless credit card

- You make the payment through your phone and track your account status within the app.