The world is no longer the same after the pandemic. We have a new normal. COVID-19 has brought in many changes, including mobile wallet adoption. The new payment methods, such as mobile wallets, disrupt business models as consumers seek safe, convenient, and contactless ways to pay for products or services.

Here are a few stats to help you understand the disruption:

- 66% of people use mobile wallets as the primary payment method.

- The market size of mobile wallet transactions is expected to increase by 80% by 2025.

The pandemic left no choice but to use mobile wallets for most transactions, and businesses had to adapt to provide contactless payment options. Besides this, mobile wallet adoption helped them improve customer acquisition, retention, and loyalty.

Mobile wallet adoption helps you save a lot of manual work by automating your payment system. Also, by understanding customer purchase patterns, you can provide personalized service to your customers.

In this blog post, we will examine the most common reasons consumers choose to use mobile wallets and how they accelerate your company’s growth. Also, we will discuss how services, such as PassKit, bring innovation to your business with digital passes.

Now, let’s start with some basics.

Mobile wallet adoption: Why mobile wallets became so popular

A mobile wallet is a digital version of a physical wallet that you can use to store payment items such as credit and debit cards or non-payment items such as digital coupons, loyalty cards, and membership cards. Its convenience and safety played a primary role in the rapid adoption of this new technology.

The COVID-19 pandemic has increased the need for contactless and germ-free payments, so mobile wallets helped avoid direct contact with any external system such as the POS of the retailer.

Security of mobile payments was uncertain in the early adoption. Still, no other payment option became more secure than mobile wallets because of the end-to-end data encryption and near-field communication (NFC).

- End-to-end data encryption ensures that your personal information never leaves the device you are using. It will keep hackers from stealing your financial information.

- NFC requires you to be at the point of sale to make a payment, and all authorization happens on your phone.

Some mobile phones even include advanced features like facial recognition, which you can use to authorize a payment.

What if the mobile device is lost or stolen?

When you use a physical wallet, it can be lost or stolen without consequences. When this happens to your virtual wallet, the cloud system locks it. You will have peace of mind knowing that your money is safe and cannot be accessed by anyone.

You might think that the pandemic is the only reason for mobile wallets’ popularity, but that’s not entirely true. The COVID-19 pandemic certainly gave a push for mobile wallets, but there are more drivers to this rapid adoption.

Let’s take a look at them.

Mobile wallet adoption: The key drivers in 2022

The pandemic forced us to start using contactless options in everything we do in our life. Digital wallets were already built into our mobile devices, so companies began promoting mobile wallets to consumers to provide contactless payment services.

Also, other reasons besides being contactless and germ-free made mobile wallet adoption so intense. Here are some of them:

- Storing payment and non-payment items in one place

- Tracking expenses

- Special discounts and coupons

- Security of mobile payments

- Buy Now Pay Later (BNPL)

- QR code-based payments

Let’s discuss each of the key drivers below to help you understand mobile wallet adoption better and learn how your business can benefit from this innovation.

1. Storing payment and non-payment items in one place

Have you ever come across a customer who would dig into their wallet to find the right credit card or membership card for that extra discount?

We’re sure you have!

Consumers can stop searching, and you can skip waiting with the help of mobile wallets as they can store all their digital passes in Apple Pay or Google Pay. Additionally, services such as PassKit integrate with mobile wallets and help customers load digital passes they can use for special offers or discounts at your store, gym, salon, cafe, restaurant, or hotel.

Trust us. It saves a lot of time and hassle.

2. Tracking expenses

Expense management can be challenging. It isn’t easy to track everyday bills, especially when paying in cash. Statistics show that 78% of millennials use online payment options to track their expenses.

Tracking expenses with mobile wallets is easy. You can sync mobile wallets with bank accounts. Mobile wallets track all digital payments, which helps you monitor your costs. In addition, you don’t have to use any other expense management application.

Such long-term benefit keeps mobile payments ongoing.

3. Special discounts and coupons

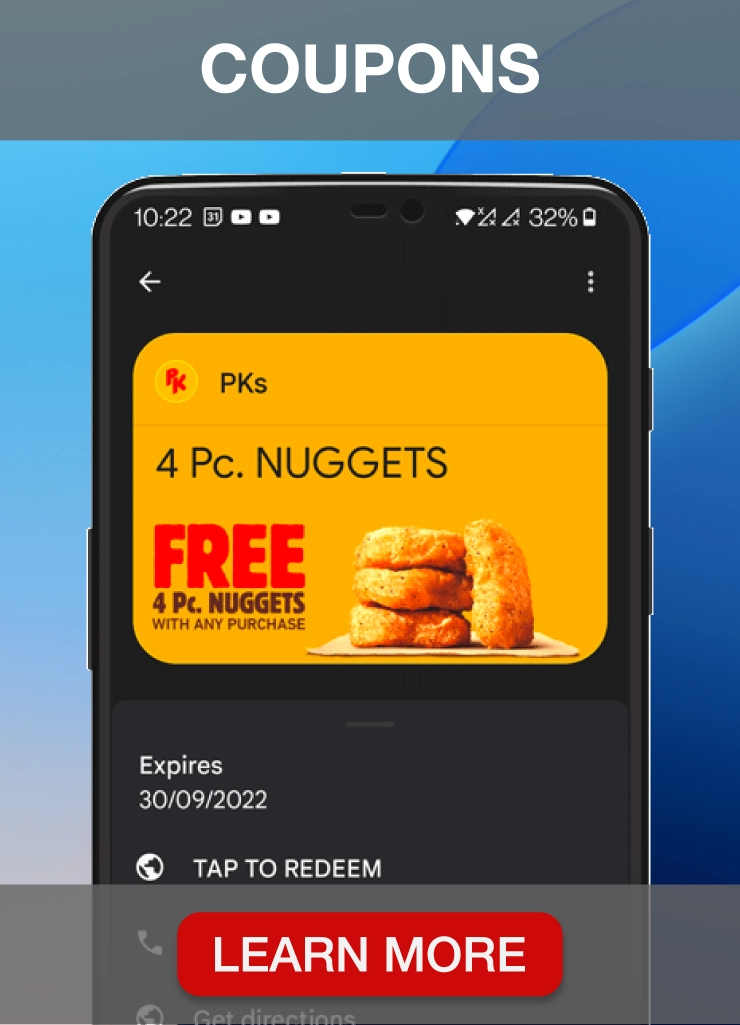

Special discounts and coupons help people save on purchases. Here is an opportunity for you as a business owner. You can use PassKit, which we will discuss in detail soon, to create digital loyalty cards, digital membership cards, or digital coupons to reward your loyal customers and increase your retention rate.

Customers can store digital passes in their mobile wallets and use them whenever at your business location. Combining special discounts with excellent service increases the customer’s lifetime value, which is the most significant benefit for any business.

The NFC technology in mobile wallets does not let a customer pass by your store, gym, salon, restaurant, or hotel. It informs customers about the exciting offers in their vicinity, motivating them to use their digital coupon before expiry.

Such customer engagement activities will make your customers delighted.

4. The security of mobile payments

It is essential to provide a secure payment solution for your customers to gain trust and create long-term relationships. Mobile payments are highly secure, but the transaction’s security entirely depends on the mobile wallet providers. They should ensure extensive and elaborative security measures like end-to-end data encryption.

The most trusted mobile wallets are Apple Pay and Google Pay, and PassKit perfectly integrates with both. The security of our customers is our priority, and we follow industry-standard mechanisms for data transmission to avoid any data breaches.

5. Buy Now Pay Later (BNPL)

Millennials make up 23% of the world population, followed by Gen Z. They believe in spending and investing their money. It introduced a new financial product called Buy Now Pay Later (BPNL) that helps you buy what you want today and pay later in installments with no additional cost.

Mobile wallets play a considerable role here. Initially, BNPL was only applicable at online stores as there was no way to scale it in offline stores. When companies started using mobile wallets to sync payments, membership cards, and rewards, consumers started using Buy Now Pay Later (BPNL) at offline stores.

The percentage of millennials using BNPL has doubled since 2019 to 41%, and Gen Z significantly increased using digital wallets from 6% in 2019 to 36% in 2021. It is evident from the numbers that the world is moving towards digital payments more rapidly than anticipated.

6. QR Code-based payments

In countries like India and China, the rising popularity of QR code-based payments has become a significant driver for mobile wallet adoption. China made around 1.65 trillion USD in transactions with QR code payments in 2016. These numbers increased by the end of 2020.

QR code makes transactions much faster since it eliminates the need for cashiers to handle each receipt individually, making day-to-day operations more efficient. These QR codes are also end-to-end encrypted, offering high security and low risk, leaving a minimal chance for anyone to access the transaction data.

Merchants have adopted QR codes because of their easy setup and convenience in receiving payments. You can also use these QR codes for receipt marketing and personalized customer offers.

How can companies benefit from mobile wallet adoption?

Technology has changed the ways we operate our businesses. Now, you can track each customer activity to analyze and understand consumer trends. Everything from manufacturing, production, and distribution to sales, advertising, shipping, and invoicing is at a click of a button.

Technology like mobile wallets can be what your business needs to succeed. Enabling contactless payments is one of the best things you can do for your company in the digital age, as it helps you optimize the customer experience.

Mobile wallet adoption has been rising since companies are moving from traditional payments to mobile payments. To speed up your business’ growth, it’s essential to remove any blockages that would stop a prospect from becoming a loyal customer.

If you do everything right in this regard, here are some ways your company will benefit from mobile wallet adoption:

- More personalized marketing

- Improved customer retention and loyalty

- Increased customer acquisition

- Increased In-store visits

Now, let’s discuss each benefit in detail.

1. Personalized marketing with mobile wallets

These days, personalized marketing revolves around mobile wallets. Consumers want to be considered special and treated accordingly. It might sound impossible if you have a vast customer base, but it can happen when you use personalization in your marketing strategy.

Continuous engagement with your customers is crucial in today’s world full of severe competition.

To improve the customer experience, set up a contactless payment system with the help of mobile wallets. Once customers start using digital wallets, you can track all purchase details. It will provide more customer data to improve your marketing efforts and begin with personalization.

Customer engagement is easier and more effective with digital loyalty cards. With PassKit, you can create digital coupons, membership, and loyalty cards aligned with your branding.

Here are a few things you can do to make their experience more personalized:

- Notify customers about the digital coupon expiration

- Provide them with digital loyalty cards with offers based on their previous purchases

- Send location-based messages to motivate store visits whenever they near your location

- Send real-time updates on loyalty points

2. Improved customer retention and loyalty

Acquiring a new customer can be 5 to 25 times more expensive than retaining an existing customer. Any serious business can relate to this fact. Customer retention is not just about repeat business but also about word-of-mouth marketing. It helps you get referrals and increase brand awareness, which results in more business.

One way to maintain and improve customer retention is by pampering and delighting your existing customers. What might be a nail spa or gym owner’s strategy for doing this? For example, they could give discounts to repeat customers. Solutions like PassKit and Loopy Loyalty can help you with this strategy.

For example, Loopy Loyalty enables running a loyalty membership program for all your customers. You can upload the list of existing customers to the app, and they will receive a personalized email with a digital punch card.

Customers can use these digital punch cards to collect loyalty points and redeem rewards after a specific threshold. It increases purchases from existing customers and significantly improves customer retention.

Here are a few customer loyalty program ideas you can implement in your business.

3. Increased customer acquisition

Finding new customers every month is not easy for any business (new or established). How can you find new customers with so many competitors on the market?

Paid advertising can give you an edge in creating awareness about your products or services. You can advertise on digital wallets and collaborate with complementary businesses to acquire new customers.

For example, if you are a nail salon, try collaborating with hair salons and spas. You can come up with combined offers such as ‘Book a spa session and get 50% off on a nail makeover.’

You can come up with ideas, and we at PassKit can help you put them into action.

4. Increased in-store visits

With PassKit, you can send personalized coupons to your customers based on their previous purchases and motivate them to come to your store whenever you have new products to offer. Even the smallest discount on your new collection will be enough to attract your loyal customers and help you increase your purchases in the process.

Key business lessons COVID-19 taught us

The COVID-19 pandemic started in 2020 and was the most unexpected situation to happen. Industries like travel, tourism, luxury, and others were forced to shut down and faced severe losses. Some businesses stopped working altogether, while others came back even stronger. How did they do it?

Here are the three fundamental business lessons we can learn from businesses that survived the COVID-19 challenges.

1. Be flexible

We have experienced a completely different world we never thought would have existed because of the pandemic. It is good to have long-term plans and core values but make sure you are flexible.

Flexibility and agility might sound similar, but a thin line differentiates them significantly. Agile businesses are the ones that came back stronger. Flexibility is a result of being agile.

Being agile means going beyond traditional boundaries to make your business as efficient as possible. Contactless payments were new to most companies in 2020, and many were unsure if they had to adopt them. Businesses were afraid for various reasons like security, technical, etc.

But the early adopters of these mobile payment services had a fair advantage to come out of the losses once the lockdown ended.

2. Leverage hard times

Hard times are a part of life. If all goes as planned, life would be boring. But how can you leverage the hard times as a business owner?

Let’s consider the travel and tourism industry as an example. During the lockdown, travel companies started promoting paid online events like music, dance, and bonfire. People who joined these events were able to socialize online with like-minded people.

Online events were not new, but the adoption was high compared to previous years. Some industries invested this time in making better products and improving their services.

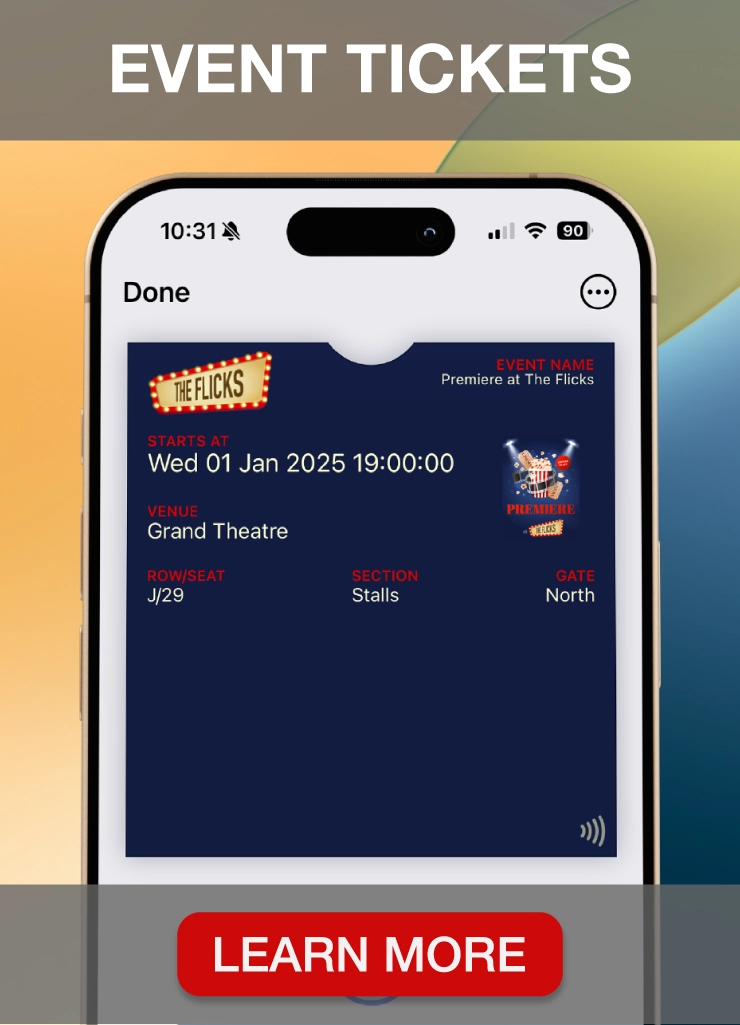

Some of these businesses created digital tickets for these online events using PassKit. All they had to do was design the digital tickets, and Passkit helped distribute them with mobile wallets. Once customers bought these tickets using mobile wallets, businesses could use the purchase data to target them to similar events in the future.

3. Make data-driven decisions

Digital wallets store data about customer expense trends. It is crucial to make the best use of this data to understand your audience and provide customized services.

Data has become the superpower of all business in the last decade, and there is no doubt about it. Cashless digital payments can only help you collect more data which is precious. If analyzed right, you will be able to crack the code and beat your competitors, providing your customers with everything they need to return to your business.

How mobile wallet payments will change the future

As technology develops, Google Pay and Apple Pay have become the go-to options for digital payments, allowing us to take actions from our mobile phones that were previously unthinkable.

Due to the wide adoption of mobile devices across the globe, retailers can no longer afford to ignore digital currencies. In 2020, 60% of China’s population (852 million) used digital wallets regularly. But we could see a decline in the usage of cash transactions in countries like Latin America, Brazil, and Mexico by 11 to 12% in 2020.

We can see the influence of artificial intelligence on digital payments that helps merchants understand customer trends even better. No matter what, mobile wallet adoption will only grow in the future.

How PassKit improves your business

PassKit is a software as a service that helps companies leverage mobile wallets to drive growth. It is a trusted solution by big giants such as Subway, Burger King, and Azul Airways.

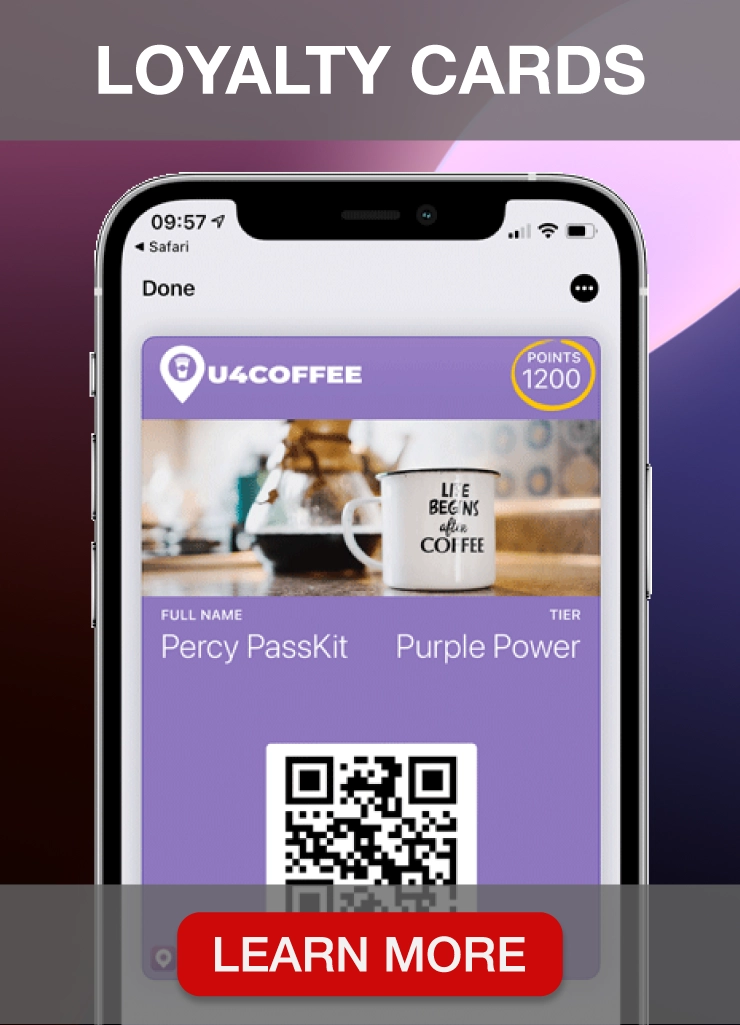

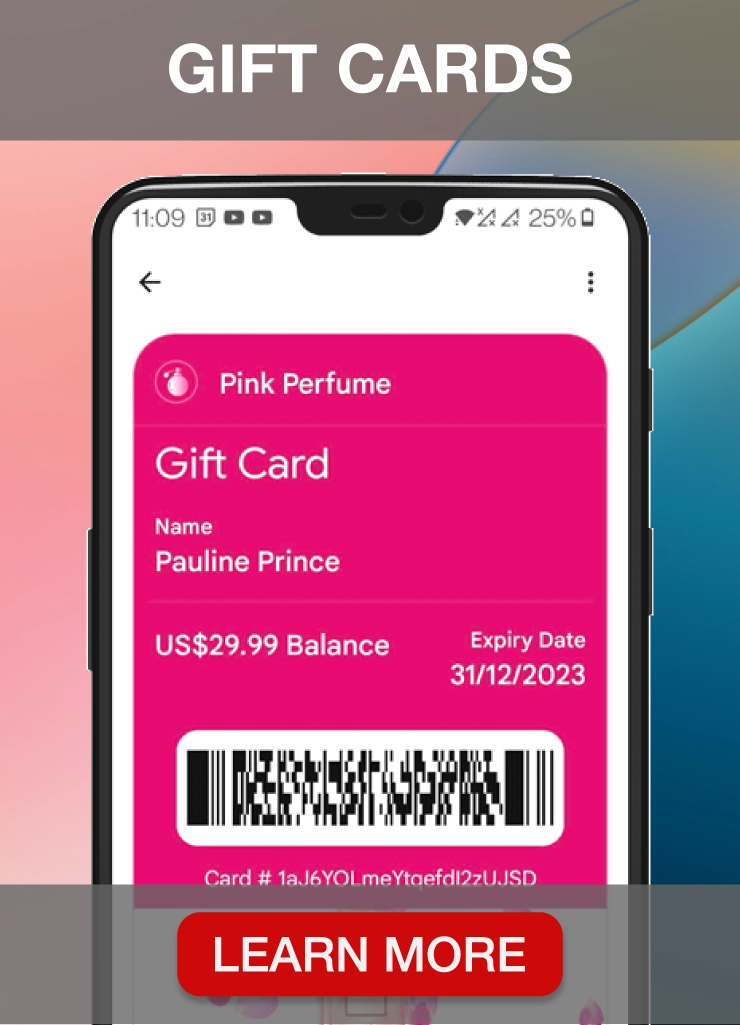

Digital wallets can hold multiple digital passes in one place. PassKit can help you create those appealing digital passes and add them to your customers’ digital wallets.

Here are some examples of digital passes you can create with PassKit:

- Loyalty cards

- Membership cards

- Coupons

- Event tickets

- Boarding passes

- Gift cards

- Stamp cards

- Community cards

These cards are completely customizable so that you can adjust them to your branding. It doesn’t matter what type of business you are in, as you can use PassKit in any industry. All that matters is your willingness to leverage the wide adoption of mobile wallets for your business.

Why choose PassKit

- It’s contactless, so it’s safer to use during the coronavirus pandemic.

- It’s paperless, so you’re saving the environment.

- It’s not necessary to design or print anything.

- It’s fast to set up, so it saves your time.

- It allows CRM and POS integration to track all loyalty data.

Become the master of mobile payments with PassKit

Mobile wallets are the future of contactless transactions. Having a solution that can ease the process of collecting payments from digital wallets will only help your businesses grow. It is easier than ever to accelerate your business growth with mobile marketing in 2022.

Passkit is a complete solution to create, manage, track, and analyze your customers’ digital journey.

Schedule a premium consultation to see what wonders PassKit can do for your business or explore it for free.

Mobile wallet adoption FAQs

What percentage of people use digital wallets?

Digital wallets made 44.5% of e-commerce transactions in 2020.

There is an estimate that more than two billion people use mobile payments globally, which accounts for around 30% of the world’s population (considering the world population to be 7.9 billion as of November 2021).

How popular is a digital wallet?

Digital wallets are gaining popularity every day. Every year, the number of digital wallet users is increasing. Not only millennials and Gen Z but people who belong to Gen X have tripled their adoption of these types of wallets, while Boomers are slowly starting as well!

What can a digital wallet be used for?

You can use digital wallets to make contactless payments. Thanks to digital wallets, traditional cash, and physical card payments are a thing of the past. You can also add digital coupons, membership cards, tickets, boarding passes, and loyalty cards with services like PassKit.

What is the most popular digital wallet?

Apple Pay and Google Pay are the most used digital wallets by iOS and Android users, respectively. If you are an existing Apple Pay user, learn how to add coupons to your Apple wallet.