Apple Wallet is now the mobile wallet of choice for all iPhone owners. It’s one of the standard iOS apps, and cannot be deleted. And with Apple Pay available in over 40 countries and regions, consumers are getting more and more used to whipping out their iPhone to transact, while leaving their old leather wallet at home.

The same is true for Google Pay. Since Google replaced Android Pay and Google Wallet with their unified Google Pay solution, the new app is now available in 35 countries (and counting). Google Pay may not be native – largely due to Google not having the same control as Apple over how the OS is deployed – it’s fast becoming the defacto mobile wallet for Android users.

Why is Apple Pay and Google Pay winning the mobile wallet war? Well, this is a topic of a longer article, but in summary it’s trust and convenience.

This makes it the perfect time for brands to get into Apple Wallet and Google Pay; to win and keep new customers by implementing frictionless, engaging, connected customer experiences.

As Xiaofeng Wang, Forrester analyst, says:

Most customers will not download a brands’ mobile apps, so business owners and marketers need to smartly leverage the mobile ecosystem to borrow mobile mobile from the popular apps that their customers already use every day. Mobile Wallets and such apps.

It’s VERY IMPORTANT TO NOTE, a consumer can use Apple Wallet or Google Pay even if they are not using Apple Pay or Google Pay to pay for goods and services. So even if your business is not set up to accept contactless payments, or you are in a country that hasn’t yet rolled out the Apple Pay, you can still get your brand into your customers’ preferred wallet app. You do this via a Pass!

Passes are digital representations of information that might otherwise be printed on small pieces of paper or plastic. They let users take an action in the physical world. Passes can contain images and a barcode, and passes can be updated at anytime. A user views and manages their passes using the Wallet app. Passes can be used to check in for flights, get and redeem rewards, get in to movies, or redeem coupons. Passes can include useful information like the balance on your coffee card, membership tier and points, your coupon’s expiration date, your seat number for a concert, and more.

So let’s take a look at an example experience. In this case we are going to look at a Loyalty Card. It’s a very typical use case of Apple Wallet and Google Pay Passes.

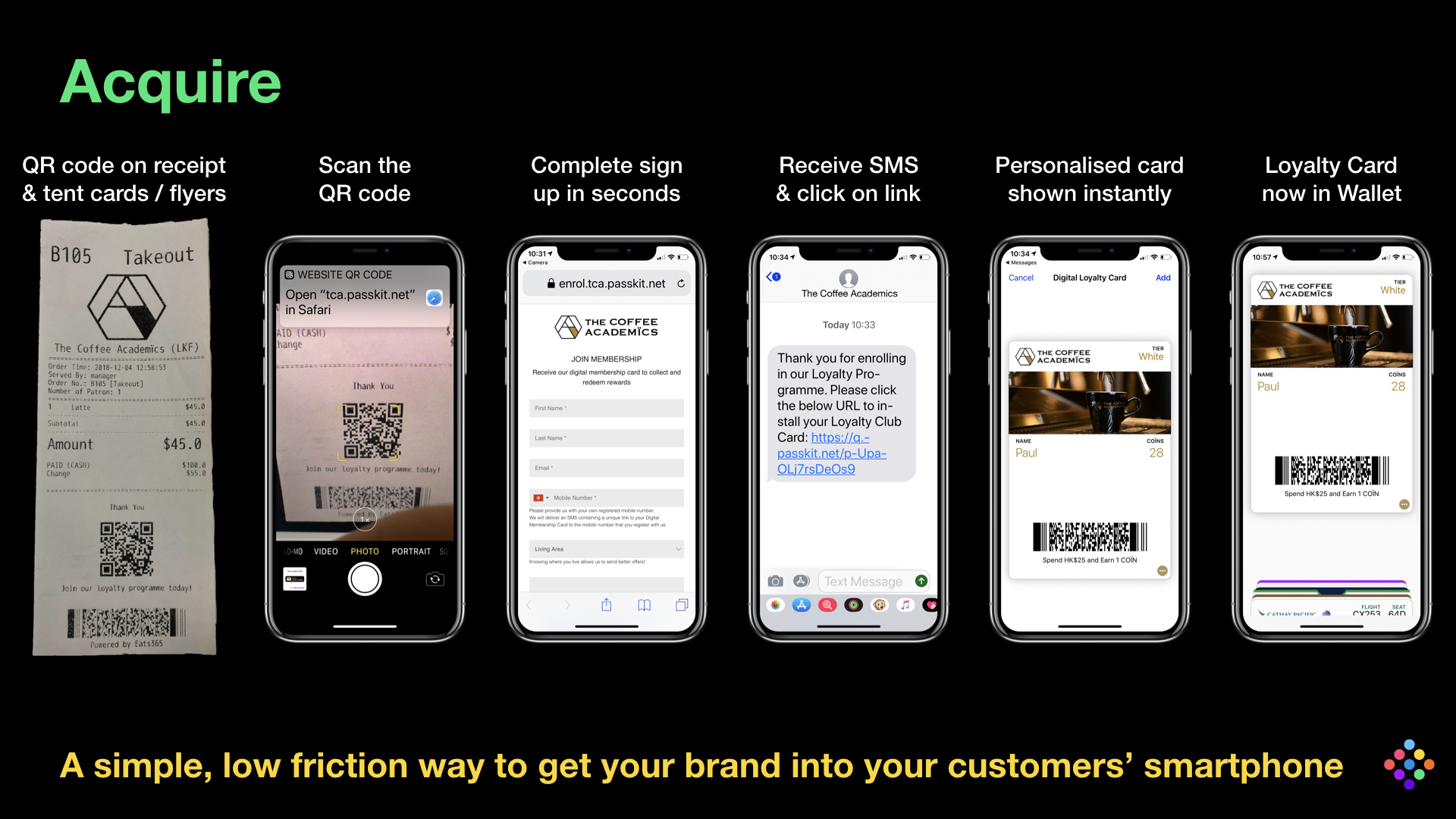

Step 1: Acquire

Rather than a customer filling in a form, and then waiting to receive a plastic loyalty card in the post the customer simply signs up on their mobile and instantly receive the digital loyalty card to store in Apple Wallet to Google Pay.

You can distribute PassKit passes via a diverse range of distribution channels (email, web, in-app, SMS, social media posts, google ads, in-store displays, tent-cards, posters etc..). In this example you can see The Coffee Academics advertise their loyalty program on the receipt. The customer scans the QR code with their phone, and is taken to a simple sign up page. Upon completion they receive an SMS with a link to their personalized loyalty card and boom… it’s in their wallet! And already with their points balance applied. This takes around 1 minute at most. Instant gratification.

A simple, low friction way to get your brand into your customers’ smartphone. No visiting iTunes of Google Play. No temporary card and waiting for a personalised card. No waiting to see the points balance.

With a plastic card in a customers wallet, how are they reminded when they are near to your store? Does the membership card jump out of their leather wallet to remind them to collect or redeem their points? Can you perfectly time an email to be delivered just as they walking past?

Well once a pass is installed in your customers’ wallet app, they can receive a lock screen message when they are in proximity of relevance. i.e. where they can use their card.

What’s more, with a single tap of the lock screen message they are taken directly to the relevant pass. They don’t have to unlock their phone. They don’t have to find and open any app. They don’t need to log in to an app to get to their card.

And with their card instantly available they can scan (or tap) and use their card as they check-in and/or check-out.

By integrating PassKit with your Point of Sale (POS) – in this example with the iPad-based POS: Eats365POS – your customers can be immediately notified of their points balance. And when they reach the next membership tier, see their digital membership card completely change. How cool is that?

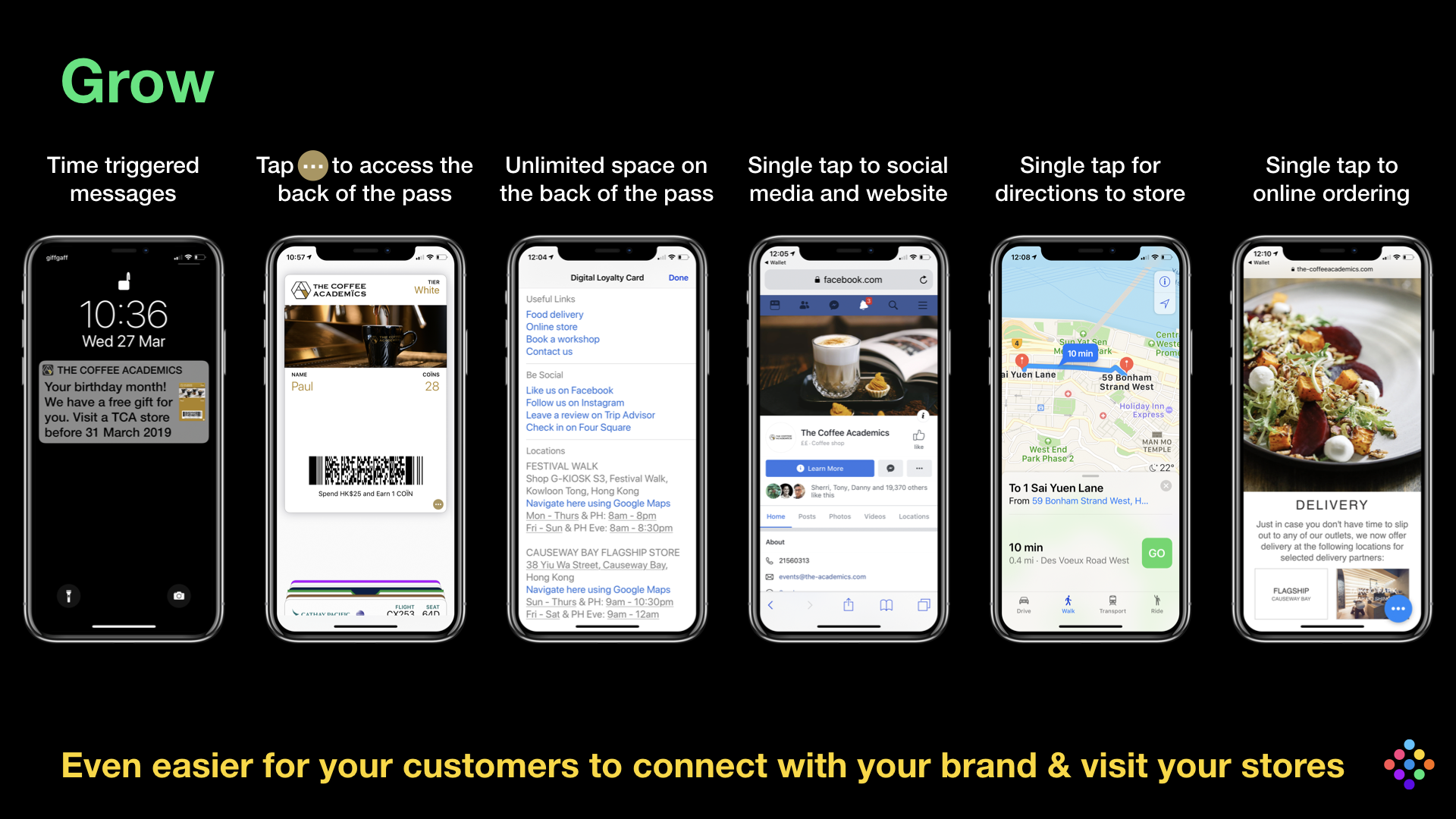

Step 3: Grow

You’ve probably got a membership database or followers already? How do you engage with them? Do you send emails? How many of your members actually open and read them? Do you know if the email is leading to someone coming back to your store? You might post fantastic content on Facebook or Instagram, but you rely on your followers opening this app and taking notice of the content. And again, can you attribute this content to a visit in store.

Using passes, not only can you trigger location based messages but you can also send messages triggered on behaviour or time. For example, on their birthday your customer can receive a lock screen message inviting them to visit your store for a birthday gift. Again, a single tap on the lock screen message takes them ton their card and when they use their card you can easily attribute the additional sales they make from this marketing message. At last you can track real online marketing to offline action return on investment.

These time-triggered messages work wonders for coupons. For example, near to coupon expiry the customer receives a polite reminder the coupon if about to expire. Brands report a significant increase in coupon effectiveness. Magnitudes higher redemptions, and increased sales along with those visits.

As you’ll see from the image above, you can also promote other services or digital connections to your brand. For example on the back of the pass (for an Apple Wallet Pass) or at the bottom of the pass (for a Google Pay Pass) you can link to apps, social media pages, online stores, contact details etc.. Each of these links will open up the user’s browser or app. Super convenience for your customers and allows you to easily (and freely) leverage your digital assets.

Get Creative

So it’s your turn to get creative with Apple Wallet and Google Pay Passes. You can start by eliminating static, boring, wasteful plastic membership cards or paper coupons and punch cards.

If you are a customer reading this, and want to experience the convenience of digital membership cards or digital stamp cards, please share this with your favourite brands.