Image source: Unsplash

Technology has transformed the way consumers handle transactions and interact with businesses. One innovation that has gained considerable popularity is NFC payment.

You may have heard of it, but what exactly is NFC?

Near Field Communication (NFC) is a wireless communication technology allowing contactless payments between a mobile device and a payment terminal.

It’s all about convenience and speed, enabling customers to transact with just a simple tap or wave of their NFC-enabled device.

But here’s the exciting part: NFC isn’t just about making quick purchases. Integrating NFC payment into your loyalty program opens the door to a new world of customer engagement and loyalty.

In this blog post, we’ll explore the complexity of NFC payment technology. We’ll discuss its advantages over traditional credit card payments and uncover the remarkable benefits of integrating NFC payments into your loyalty program.

Understanding NFC payment technology

Image source: CFI

NFC technology is based on short-range wireless communication, allowing two devices to exchange data when brought close together.

This technology uses electromagnetic radio fields to enable secure and convenient contactless transactions.

Your customers can initiate a contactless payment by simply touching or waving NFC-enabled devices, like smartphones or smartwatches, close to an NFC payment terminal.

How do NFC payments work?

Image source: Kevin

NFC mobile payments integrate hardware and software components in the mobile device and the payment terminal.

When customers initiate an NFC payment, their device connects with the terminal using radio frequency identification (RFID).

This connection enables the secure transmission of payment information, including credit card details or mobile wallet data.

Once the system authorizes the transaction, it processes the payment and generates the receipt.

A short overview of NFC payment providers

Image source: Forbes

Several major players have entered the NFC payment arena, offering solutions to facilitate contactless shopping.

- Google Wallet allows users to securely store credit and debit card information on their devices, making payments using NFC technology. It also supports loyalty program integration and enables users to send money to friends and family.

- Apple Wallet is available on iOS devices and provides a seamless NFC payment experience by allowing users to add credit, debit, and prepaid cards. It also supports loyalty programs, boarding passes, digital tickets, and more.

- Samsung Pay offers NFC-based mobile payments and compatibility with traditional magnetic stripe card readers. It allows Samsung users to make payments at NFC-enabled and non-NFC terminals, increasing their convenience.

- Square Wallet is a popular payment solution that leverages NFC technology. It allows users to make payments at Square merchants by simply tapping their devices.

- PayPal is the leading online payment platform that has integrated NFC technology into its mobile app. Users can link their PayPal accounts to NFC-enabled devices and make secure contactless payments.

But how do NFC payments differ from conventional credit card payments? Let’s explain in the following section.

NFC payments vs traditional credit card payments: What’s the difference

With traditional credit card payments, customers need to swipe or insert their card into a payment terminal physically. They might also need to sign a receipt or enter a PIN to finish the purchase.

NFC payments offer a more convenient and faster experience. Instead of using a physical card, they can tap or wave their NFC-enabled device near the payment terminal, like their smartphone or smartwatch. No swiping, inserting, or signing is required.

What are the advantages of using NFC payment technology?

Image source: KeyUA

Let’s explore why NFC payments are becoming increasingly popular.

- Improved accessibility and convenience for customers: NFC payment technology allows customers to make payments using their smartphones or wearable devices, eliminating the need to carry physical wallets, cash or cards. This convenience appeals to tech-savvy consumers who prefer to streamline their daily activities.

- Faster checkout: NFC payments significantly speed up the checkout process. With a simple tap or wave, customers can complete transactions swiftly, reducing waiting times and enhancing overall customer satisfaction.

- Decreased time per transaction: Compared to traditional credit card payments that require manual card insertion and verification, NFC payments are much quicker. It allows businesses to process more transactions within a given period, boosting efficiency.

- Reduced fraud risk and increased security: NFC payments employ advanced encryption technology and tokenization to protect sensitive payment information. Unlike traditional credit card payments, NFC transactions do not require exchanging actual card details, reducing the risk of data theft or skimming. Additionally, NFC payments often require user authentication, such as fingerprint or facial recognition, adding an extra layer of security.

If these advantages sound appealing, there are a few more aspects to consider before incorporating NFC into your customer incentive program.

Common challenges when implementing NFC payment in a loyalty program

While NFC payments offer numerous benefits, integrating them into a loyalty program can present specific challenges. Let’s discuss some of them.

- Technical compatibility: Ensuring the payment infrastructure and the loyalty program system are compatible with NFC technology can be complex. It may require updates to existing hardware and software or a complete system overhaul.

- Security concerns: Any payment-related technology introduces security concerns, and NFC is no exception. You must address potential vulnerabilities and implement robust security measures to protect customer data and prevent fraudulent activities.

- Integration with existing systems: Integrating NFC payment capabilities with an existing loyalty program infrastructure can be challenging. It requires seamless synchronization between payment processing, loyalty rewards, and customer databases to provide a unified and streamlined experience.

- Customer adoption: Despite the increasing popularity of NFC payments, some customers may still be unfamiliar with or hesitant to adopt this technology. Educating customers about the benefits and ease of NFC payments becomes crucial to encourage adoption.

- Cost: Implementing NFC payment technology and integrating it into a loyalty program can involve significant upfront costs. These costs may include hardware upgrades, software development, staff training, and ongoing maintenance expenses. Small businesses with limited budgets must carefully evaluate the return on investment and weigh the benefits against the costs.

Although it may seem challenging, we have a solution that simplifies overcoming these obstacles.

How PassKit connects NFC payments and loyalty programs

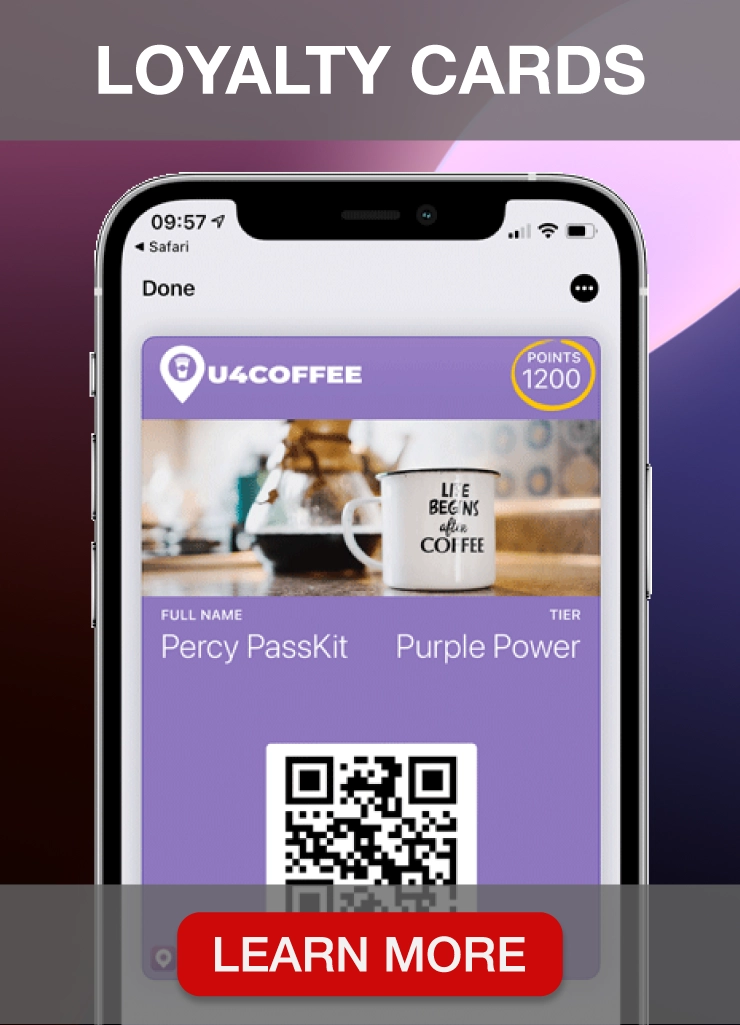

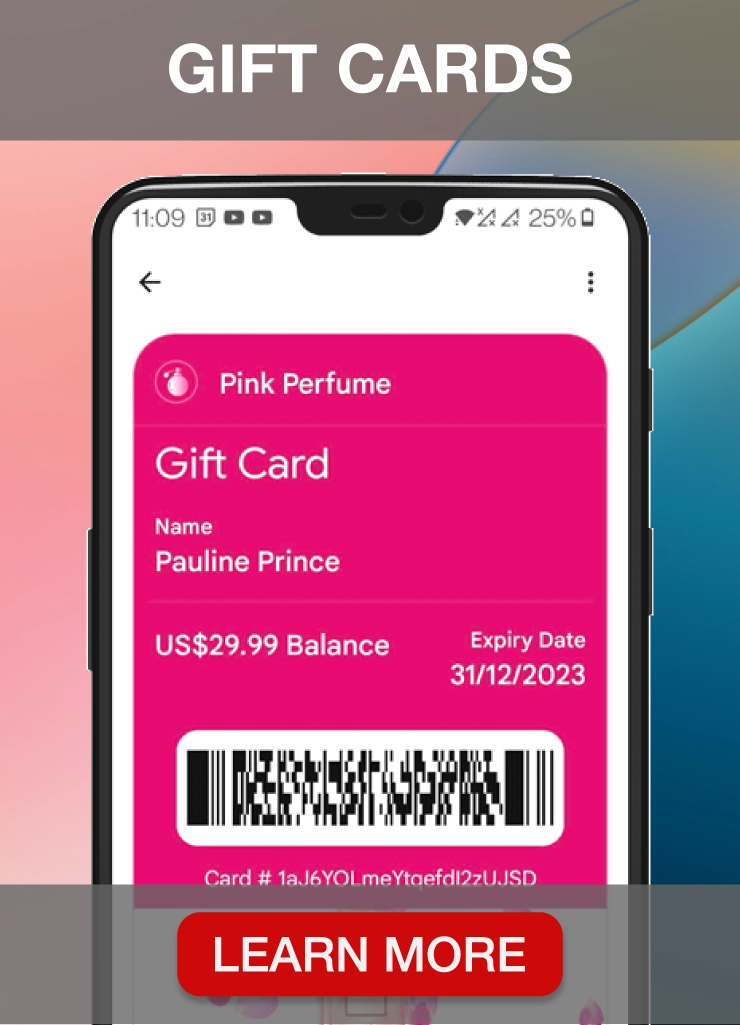

PassKit is an all-in-one customer loyalty software you can use to turn customer loyalty ideas into a reality. Our platform lets you boost your customer experience strategy by providing consumers with the following:

- Digital membership cards

- E-gift cards

- Loyalty reward cards

- Various digital passes

Your customers can store these cards in mobile wallets like Apple and Google Wallet and use them at your business location to collect points and redeem rewards.

It all leads to a connected customer experience.

With multichannel distribution capabilities, PassKit can automatically send an enrollment request to Apple and Google Wallet users who haven’t yet installed their cards.

Your NFC payment terminals must support the Apple VAS and Google SmartTap protocols to make this possible.

PassKit can send the enrollment request to install an existing card or enrol the user as a new loyalty program member. The outcome depends on whether the customer presented a membership card during the purchase transaction.

Start a 45-day free trial to evaluate this feature.

How PassKit enhances your loyalty program

Image source: Freepik

PassKit revolves around an advanced software development kit (SDK), providing businesses with the tools and resources to seamlessly integrate NFC payments and loyalty programs.

Here’s how it works.

Loyalty program integration

PassKit enables you to integrate your rewards programs with NFC payments seamlessly. This integration ensures that customers can earn and redeem loyalty rewards during NFC transactions.

For example, customers can earn loyalty points or receive special discounts or promotions when making NFC payments.

NFC payment processing

PassKit facilitates the processing of NFC payments by securely transmitting payment information between the customer’s NFC-enabled device and the payment terminal.

This process ensures efficient authorization and completion of transactions, delivering a seamless customer payment experience.

Data analysis and insights

PassKit provides robust data analysis and reporting tools and allows you to deliver personalized loyalty offers and rewards to customers during NFC transactions.

You can tailor loyalty rewards and incentives based on customer preferences and behaviors by leveraging customer data, purchasing patterns and transaction history.

This approach increases customer engagement and strengthens loyalty program effectiveness.

Streamlined administration

PassKit simplifies the administration of loyalty programs through its intuitive dashboard.

You can efficiently manage loyalty program settings, track customer engagement, distribute loyalty business cards, and generate detailed reports.

It helps you save time and resources, allowing you to focus on delivering exceptional customer experiences.

Scalability and flexibility

PassKit accommodates businesses of all sizes, from small businesses to large enterprises. Our highly scalable solution can adapt to your evolving needs and business growth.

Our flexible platform allows you to customize loyalty program features, rewards, and promotions according to your specific requirements.

Increased customer acquisition

When you accept NFC mobile payments as part of a loyalty program, you can attract new customers who prefer cashless and contactless payment options. It can lead to higher sales and business growth.

Improved inventory control

By tracking customer transactions and preferences, you can gain insights into inventory demands and make informed decisions about stock replenishment.

It improves inventory control and reduces the likelihood of stockouts or excess inventory.

Competitive advantage

As NFC payments continue to gain popularity, businesses that integrate this technology into their loyalty programs gain a competitive edge.

By offering convenient and secure payment options and loyalty rewards, you can differentiate yourself from competitors and attract tech-savvy customers.

Environmental friendliness

NFC payments contribute to environmental sustainability by reducing the need for paper receipts and physical cards. Promoting digital transactions can contribute to a greener and more eco-friendly business environment.

Accepting NFC mobile payments enhances the customer experience, streamlines transactions, enables personalized offers, provides valuable data insights, and strengthens customer loyalty.

PassKit empowers you to unlock the full potential of NFC payments within your loyalty program, driving customer engagement and maximizing the benefits of loyalty initiatives.

Start a 45-day free trial to evaluate all features.

NFC Payment: The bottom line

Image source: Unsplash

If you accept NFC payments, you can significantly enhance your loyalty program, providing customers with a seamless and convenient experience.

Adopting an NFC-enabled reader opens up a world of possibilities for mobile contactless payments, making transactions quick and effortless.

Implementing NFC payment technology allows you to tap into the growing trend of mobile payments, enabling customers to spend money using their smartphones and other NFC-enabled devices.

It improves the overall customer experience, encourages repeat business, and boosts customer loyalty.

Regarding loyalty programs, PassKit stands out as the best solution.

PassKit offers a comprehensive suite of features and tools that seamlessly integrate with NFC payments, making it easier than ever to implement and manage a successful loyalty program.

With PassKit, you can effortlessly track customer transactions, offer personalized rewards and incentives, and gain valuable insights into customer behavior.

By accepting NFC payments and utilizing PassKit for your loyalty program, you can create a win-win situation for your business and customers. You provide a convenient and modern payment method while fostering customer loyalty and driving repeat sales.

Take advantage of the opportunities NFC payments bring to your loyalty program. Embrace this technology, and with the help of PassKit, take your loyalty program to new heights of success.

Start your 45-day free trial now!

FAQs about accepting NFC payment

Image source: Freepik

What is NFC payment?

NFC payment refers to using Near Field Communication technology to facilitate contactless payments between a mobile device and a payment terminal. It lets customers make secure and convenient transactions by tapping or waving their NFC-enabled devices.

How do I pay with NFC?

To make an NFC payment, ensure your mobile device has NFC capabilities and the payment terminal supports NFC. Unlock your device, hold it near the payment terminal, and follow the prompts on your screen to complete the transaction.

How do I accept NFC payments on my phone?

To accept NFC payments on your phone, you must have an NFC-enabled device and install a compatible payment processing app or software. These solutions will allow you to process NFC payments from your customers securely.

Does my phone have NFC payment?

Most modern smartphones, including models from popular brands like Apple, Samsung, and Google, have NFC capabilities. To check if your phone supports NFC, go to the device’s settings and look for the NFC option. Alternatively, refer to the manufacturer’s specifications or consult the user manual.